PABCO Paper: Products, Competitors, and the EPD Opportunity

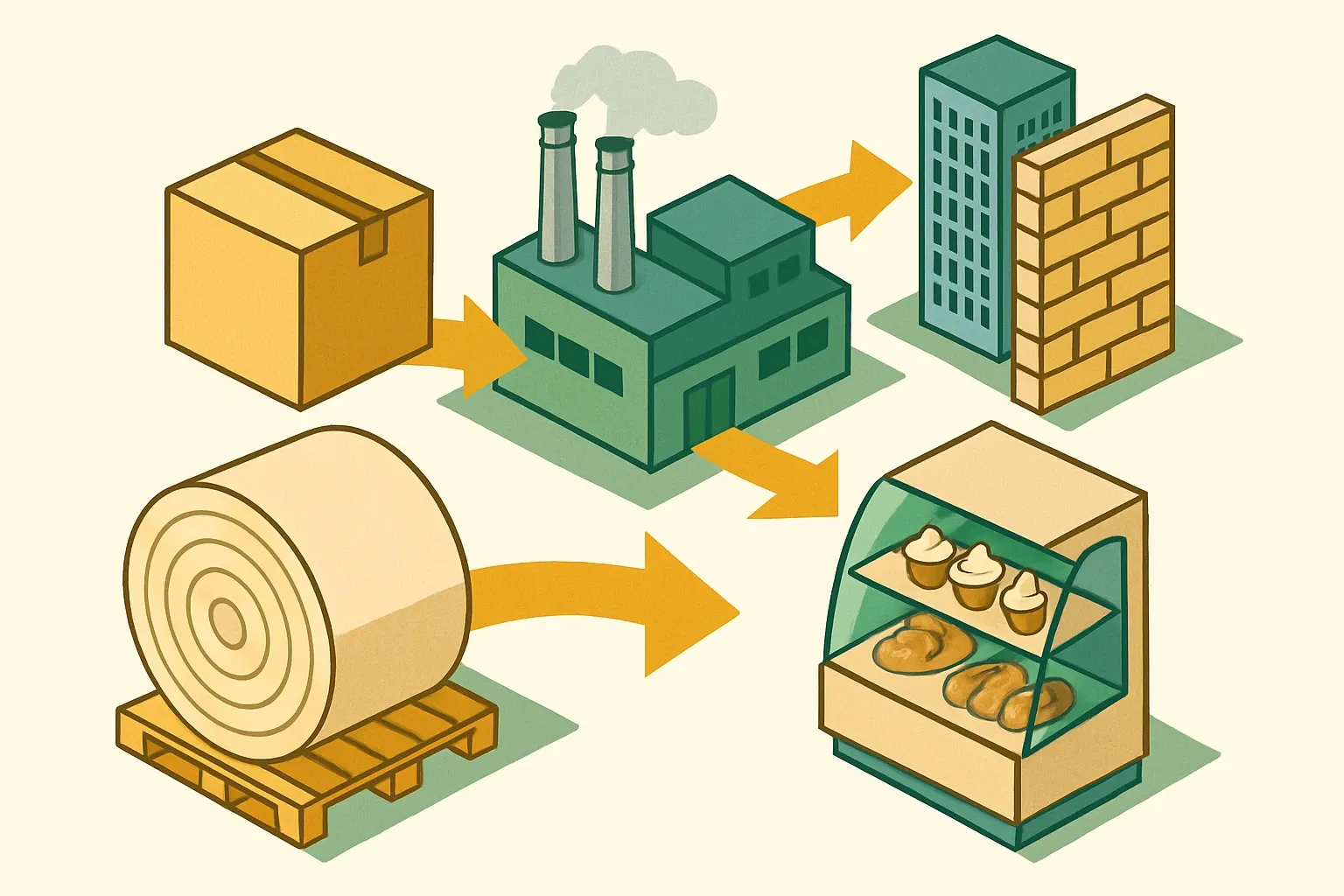

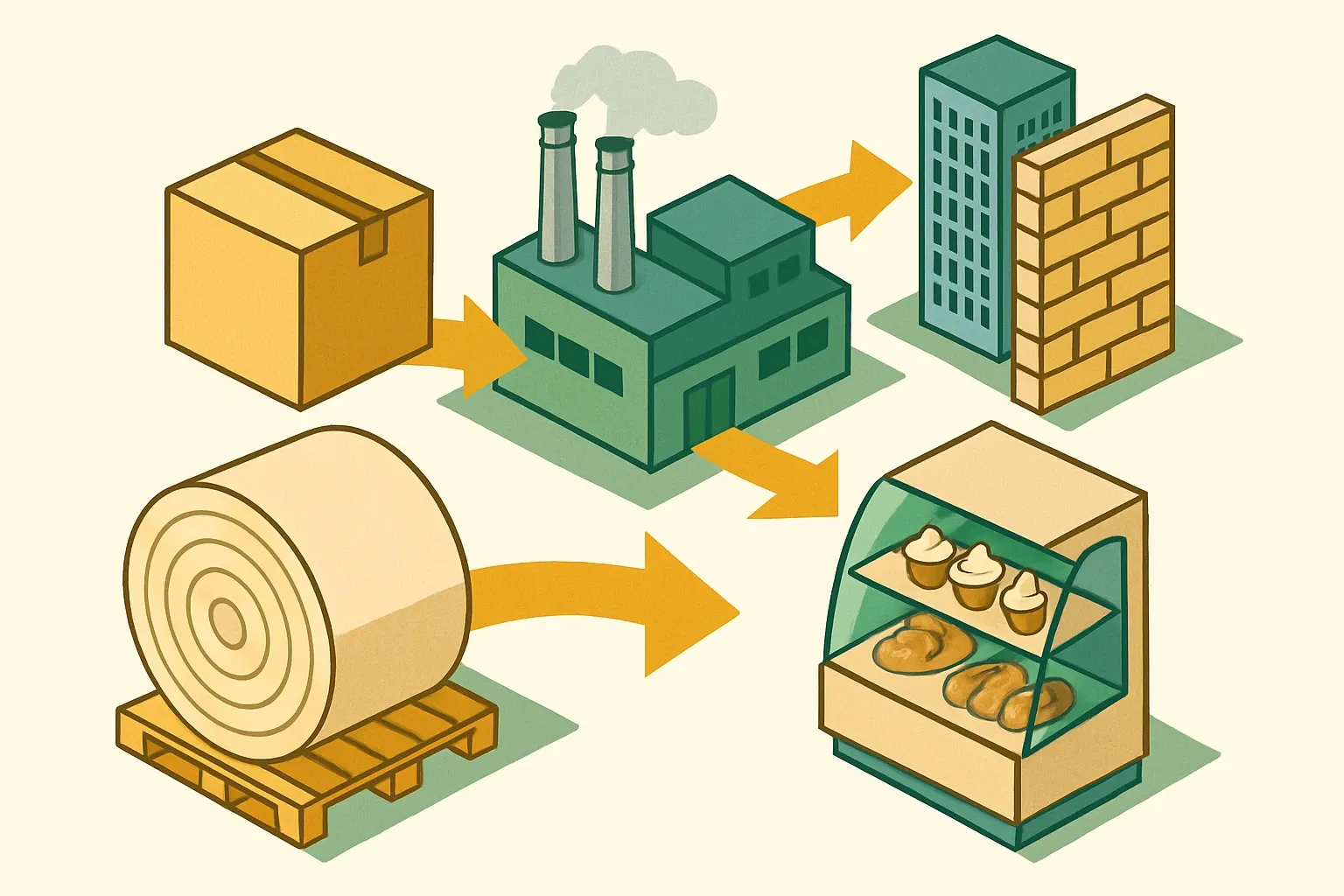

PABCO Paper sits upstream of walls, boxes, and bakery cases. That makes their data powerful. If their core products carried product‑specific EPDs, downstream brands could document lower‑risk numbers faster, earning preference on projects that now scrutinize embodied carbon from day one (USGBC, 2025). Here is where they play, how broad the line looks, and the commercial upside of closing the EPD gap.

Who PABCO Paper is

PABCO Paper, based in Vernon, CA, manufactures industrial papers from 100% recycled fiber for building and packaging uses, including gypsum wallboard lining and specialty grades. Their sustainability page outlines energy, recycling and stewardship practices and links to supporting documents such as VOC analyses and SDS sheets (PABCO Paper Sustainability).

What they make and how broad the line looks

Public materials indicate four core families: gypsum liner, chip and trim for tubes and partitions, a pink specialty grade for bakery boxes, and linerboard for corrugated packaging. Each family comes in multiple calipers and widths. That points to product variants in the dozens, possibly low hundreds across weight, finish, and roll dimensions.

EPD coverage snapshot

As of December 11, 2025, we could not locate any published product‑specific EPDs for PABCO Paper. Their sister company in panels and several peer paper makers do publish EPDs for downstream products, but the paper inputs themselves are not yet visible through public EPD registries. That is a missed lever, since paper often carries meaningful cradle‑to‑gate impact in wallboard and packaging LCAs.

Why this matters commercially in 2025

LEED v5 is ratified and shifting attention to embodied carbon baselines and reductions, which tightens documentation expectations for materials in structure and enclosure as well as finishes (USGBC, 2025). LEED certified 6,000 commercial projects in 2023 totaling 1.36 billion square feet, a market signal that continues to grow into 2024 and 2025 (USGBC, 2023). When a buyer must choose between two similar products, the one with a current, verified EPD usually avoids conservative penalties in the carbon tally. That can be the tie‑breaker.

Likely best seller without an EPD

Gypsum liner looks like the anchor product. It feeds wallboard lines daily, inside PABCO Gypsum and at other board plants. A product‑specific, third‑party verified EPD for gypsum liner would let board makers model A1 to A3 with measured data rather than generic estimates. That improves confidence in their own EPDs and can reduce modeled GWP where recycled content and efficient energy are verified.

Want the latest EPD news?

Follow us on LinkedIn to get relevant updates for your industry.

Competitors PABCO Paper meets in the wild

In gypsum liner and industrial grades, the competitive set likely includes Smurfit WestRock, International Paper, Packaging Corporation of America, Pratt Industries, and Graphic Packaging for linerboard and specialty kraft. On the wallboard side, the downstream brands that benefit from strong input data include USG, CertainTeed, Georgia‑Pacific Building Products, National Gypsum, Knauf, and American Gypsum, many of whom already publish product EPDs for finished boards. That ecosystem is where EPD‑ready inputs win friends quickly.

The spec risk today

If a bakery box grade, tube chip, or gypsum liner ships without an EPD, customers serving LEED‑driven projects or corporate carbon policies have to plug in conservative defaults. In practice, that can push a purchase toward a supplier with a verified declaration on file. It is not about being the cheapest. It is about being the easiest to document. And that eases sales cycles.

Where to start on EPDs with minimal friction

Think in families, not one‑off SKUs. One gypsum liner EPD can credibly represent a range of basis weights if the LCA is set up with appropriate representativeness. Same idea for chip and linerboard families. Pick a clean reference year, lock data from purchasing, pulping, energy, water, and yield, then select a PCR common in your buyers’ EPDs for finished goods. A PCR is the rulebook of Monopoly. Ignore it and the game falls apart.

Quick win roadmap

- Gypsum liner family. Prioritize this first EPD to help wallboard customers sharpen their A1 to A3. Include recycled content and energy improvements that already exist.

- Chip and partition grades. Publish a family EPD so converters that serve food, beverage, and industrial can document faster.

- Linerboard. Even one mill‑specific EPD can reduce questions from box plants that sell into retail and e‑commerce programs.

A note on data and speed

The heavy lift is not the modeling. It is corralling plant data across shifts and systems. Teams that streamline internal data collection and project management finish months faster, with fewer back‑and‑forths, which is definately what sales needs when a bid window opens.

For context seekers

USGBC ratified LEED v5 on March 28, 2025, with market guidance now live for teams planning embodied‑carbon documentation in design and procurement (USGBC, 2025). The 2023 certification surge shows the demand side is real and growing, so upstream documentation now pays off downstream in more ways than one (USGBC, 2023).

Bottom line for manufacturers

PABCO Paper is a focused producer with a compact set of product families and many size variants. That is perfect for family EPDs that cover tens of SKUs with one project. Start with gypsum liner, follow with chip and linerboard, and publish where your customers already look. The ROI shows up when your product gets short‑listed without extra emails, and your customers’ EPDs get easier to update each year.

Frequently Asked Questions

Does PABCO Paper publicly claim 100% recycled content for its papers?

Yes. Their sustainability page states they use 100% recycled pre‑ and post‑consumer waste to make wallboard lining and specialty papers, and it links to supporting documents. See their page for details and downloads.

How many products does PABCO Paper likely offer?

Across gypsum liner, chip/trim, pink bakery grade, and linerboard, with multiple calipers and widths, the line likely spans dozens of SKUs, possibly low hundreds when accounting for roll and sheet dimensions.

Do competitors publish EPDs PABCO Paper’s customers rely on?

Yes. Many wallboard brands publish product EPDs for gypsum boards. Packaging peers increasingly publish EPDs for paperboard grades, which helps converters document embodied carbon quickly.

What is the fastest route to a first EPD set for a paper mill?

Group SKUs into families, fix a reference year, align on a suitable PCR, and prioritize the highest‑volume grade first. Capture purchasing, pulping, energy, water, waste, and yield data at plant level, then verify and publish with a recognized program operator.