Holcim ECOPact and today’s low‑carbon concrete options

Specs are tightening on embodied carbon while strength, finish, and schedule stay non‑negotiable. ECOPact is Holcim’s headline answer, but it is not the only game in town. Here is how the big low‑carbon mixes compare, what their numbers really mean, and how to translate those claims into EPDs that actually win bids.

Why concrete’s carbon mostly comes from cement

Cement is a small slice of concrete by mass yet drives the bulk of its footprint. Analyses show cement accounts for nearly 80% of concrete’s CO2 emissions, which is why the fastest wins come from lowering clinker, swapping binders, or capturing process emissions (World Resources Institute, 2024) (WRI, 2024). Buildings overall remain a major lever, contributing about 34% of energy and process‑related CO2 in 2023, so material choices matter commercially as much as environmentally (UNEP Global Status Report, 2025) (UNEP, 2025).

ECOPact in plain English

Holcim positions ECOPact as a ready‑mix range that delivers at least 30% lower CO2 than a standard CEM I or OPC reference, without offsets (Holcim, 2025) (Holcim, 2025). In project spotlights Holcim cites larger cuts, sometimes up to 90%, depending on local materials, strength class, and mix design constraints (Holcim, 2024). Those headline ranges are directional. Always check the plant and mix specific EPD before you promise a number to a customer.

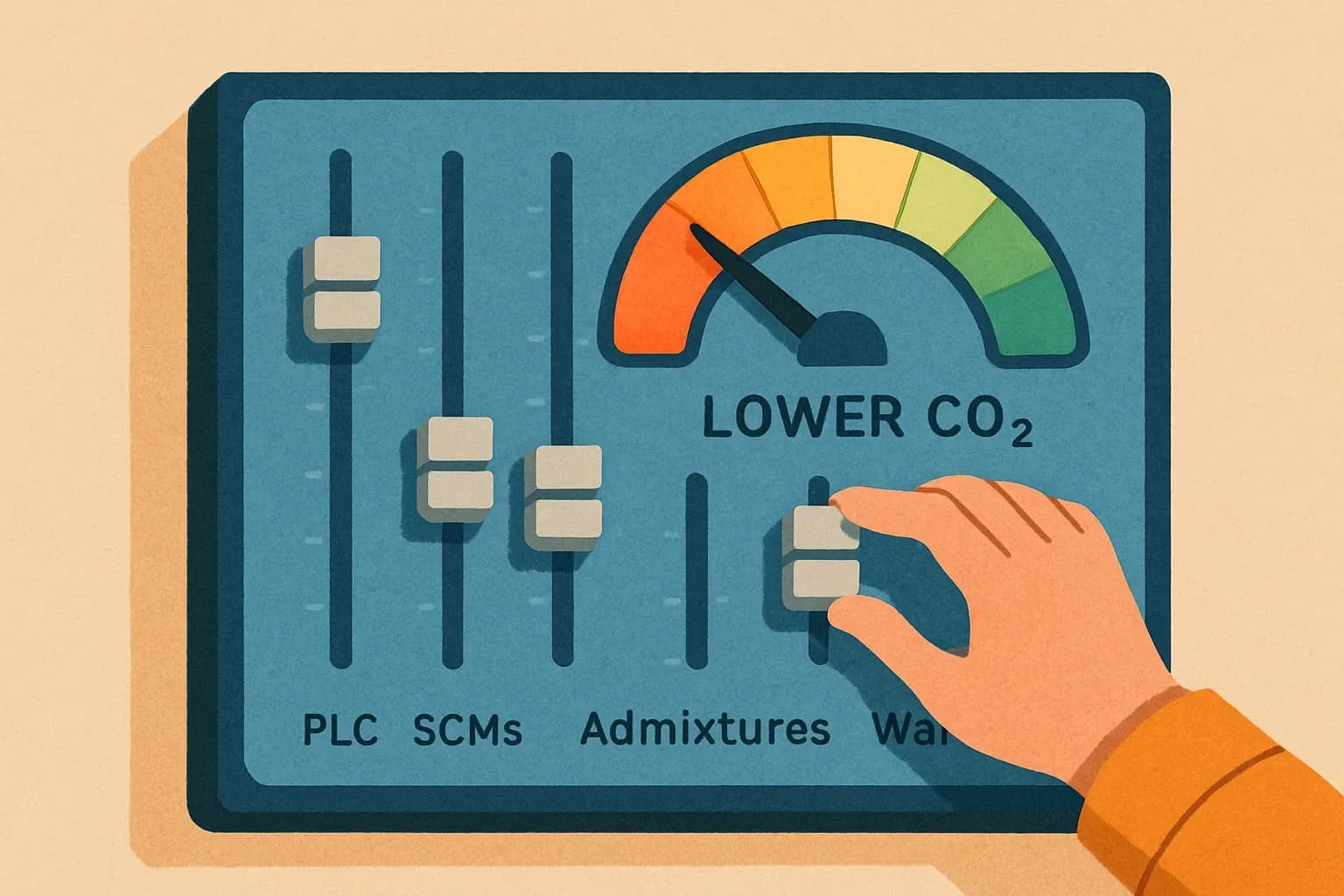

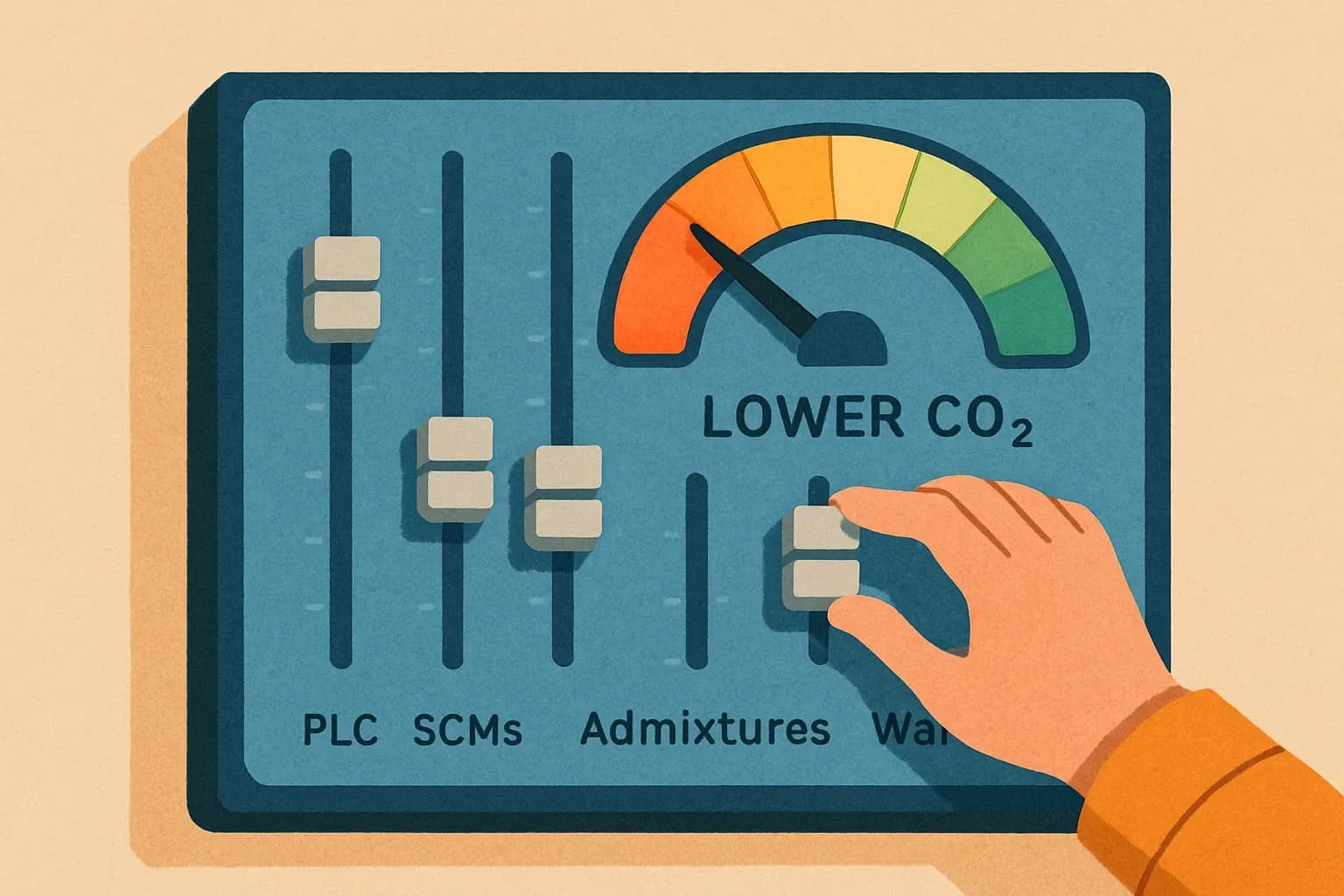

How ECOPact typically gets the reduction

Think of the mix design like remixing a classic song. You keep the hook, cut background noise, and add cleaner instruments. Core levers include portland‑limestone cement substitutions, high‑quality SCMs such as slag and natural pozzolans, and admixture‑enabled water and cement factor optimization. PLC alone commonly cuts cement CO2 by up to about 10% versus traditional portland cement, now approved by all 50 state DOTs, which makes nationwide adoption practical for producers (PCA, 2024).

What good looks like on an EPD

A PCR is the rulebook of Monopoly. Ignore it and the game falls apart. For North America, most concrete EPDs are cradle‑to‑gate A1–A3 and are valid for up to five years under ISO 14025 and EN 15804, subject to operator rules and updates when parameters change (UL Solutions, 2025). Federal buyers publish strength‑class‑based GWP thresholds that are read directly from EPDs, for example GSA’s 2025 IRA Low‑Embodied‑Carbon concrete limits by PSI class (GSA, 2025) (GSA, 2025). If your EPD system boundary or declared unit does not align with the spec, expect delays.

ECOPact vs other low‑carbon offerings

Low‑carbon concrete is now a category, not a single product. Here are common reference points to calibrate expectations and keep bids honest:

- CEMEX Vertua. U.S. Vertua Classic markets 30% to 49% CO2 reductions against a Portland‑cement baseline, with higher tiers positioned for larger cuts or net‑zero via offsets depending on locale (CEMEX, 2024).

- Heidelberg Materials EcoCrete and evoBuild portfolio. Public claims in Europe cite 30% to 66% reductions for EcoCrete depending on application, achieved without compensation measures, and the company launched evoZero near‑zero cement backed by CCS at Brevik in 2025 (Heidelberg Materials, 2022; Reuters, 2025).

- The PLC baseline. With PLC now broadly standard in U.S. public work and typically around a 10% cement‑level CO2 cut, many “low‑carbon” mixes start from this lower baseline rather than historic Type I/II assumptions, which changes what “30% better” really means at the mix level (PCA, 2024).

Numbers move with local materials, SCM availability, and required cure time. That is why a mix‑specific, third‑party verified EPD is your only dependable comparison tool.

Reading the fine print like a pro

Two mixes can share a brand name and still publish different GWPs. When you review an EPD, confirm five things quickly: the strength class and slump range match your spec, the declared unit is 1 m³ or 1 yd³ of ready‑mix, the boundary is A1–A3 unless the buyer requires more, the reference cement type is clear, and the PCR version is current or still recognized by the operator. Most PCRs run on a five‑year review cycle, and an expired PCR does not automatically invalidate published EPDs, but it can affect renewals and comparability notes (UL Solutions, 2025).

Where the market is setting the bar

Public owners publish absolute numbers, not vibes. GSA’s April 10, 2025 table shows, for example, a top‑40% GWP limit of 291 kg CO2e per m³ at 3000 psi and 326 kg CO2e per m³ at 4000 psi, read from EPDs, with adjustments for high‑early mixes where justified (GSA, 2025). If a supplier’s EPD cannot clear those thresholds for the target strength class, the bid team spends days value‑engineering instead of booking revenue.

Commercial takeaway for manufacturers

Low‑carbon concrete is not a logo, it is a portfolio of levers you control. Cement substitutions, SCM strategy, and admixtures lower embodied carbon while keeping finish and pumpability. The EPD turns that effort into a number your customer can use. Getting to a verified, aligned EPD faster protects margin because your product will be evaluated on performance and quantified carbon rather than price alone.

How to secure EPDs with less friction

Pick a partner who can shoulder data collection across plants, choose the right PCR for comparability, and publish with the operator your customers prefer. The heavy lift is wrangling utility bills, clinker factors, SCM rates, and allocation assumptions so your team can stay on the plant floor. Fast, high‑quality EPDs pay for themselves when even one mid‑sized win lands because you had the right document at the right time. This is basic, but too many teams still miss it due to messy internal data and unclear ownership of LCA tasks. Do not repeat those mistakes.

A short pre‑bid checklist

- Verify the mix‑level EPD matches the exact strength class, exposure class, and admixture family to be supplied.

- Confirm the EPD’s declared unit, boundary, and PCR version align with the buyer’s rules.

- Recalculate expected GWP against the owner’s threshold table before you price.

- Lock plant‑specific SCM availability and PLC type so the published EPD remains representative during production. Any last‑minute swap can break compliance and create costly rework.

Bottom line

ECOPact gives you a credible, scalable path to cut embodied carbon, and competitors offer similar families with different knobs to turn. The proof buyers accept sits in an up‑to‑date, third‑party verified EPD that meets their criterias and threshold tables. Build your mixes to the math, not the marketing, and you will win more specs with less stress.

Frequently Asked Questions

What carbon reductions does ECOPact claim compared to standard concrete, and are those numbers verified?

Holcim states the ECOPact range delivers at least 30% lower CO2 than standard CEM I or OPC concrete, with higher reductions possible in specific mixes. Always validate project claims on the plant and mix‑specific EPD before committing numbers (Holcim, 2025).

Is portland‑limestone cement now accepted broadly and how much does it reduce CO2?

Yes. All 50 U.S. state DOTs approve PLC Type IL. PLC typically reduces cement‑level CO2 by up to about 10% versus traditional portland cement, which helps producers reach lower‑carbon mix targets at scale (PCA, 2024).

How long is a concrete EPD valid and does a PCR expiry void it?

Most EPDs are valid for up to five years under ISO 14025 and EN 15804. PCRs are commonly reviewed on a five‑year cycle. A PCR update does not automatically void an existing EPD, but it can affect renewal timing and comparability language (UL Solutions, 2025).

What GWP numbers do federal buyers look for on EPDs today?

GSA’s April 10, 2025 IRA LEC limits list strength‑class thresholds, for example 291 kg CO2e per m³ at 3000 psi and 326 kg CO2e per m³ at 4000 psi for the top‑40% tier, drawn directly from EPDs (GSA, 2025).