Crown Polymers: EPD reality check for resinous floors

Crown Polymers builds resinous flooring systems for tough spaces, from food plants to healthcare corridors. The spec game is tilting toward brands with product‑specific EPDs, so the question is simple. How well is Crown covered today, and where could that hold back project wins in markets that ask for verified carbon data?

Who they are and where they play

Crown Polymers focuses on resinous flooring and related chemistries for commercial and industrial projects. Think epoxy, polyaspartic and urethane cement systems used in back‑of‑house, labs, and clean production zones. They are a pure play in floor coatings rather than a broad building materials conglomerate.

Portfolio at a glance

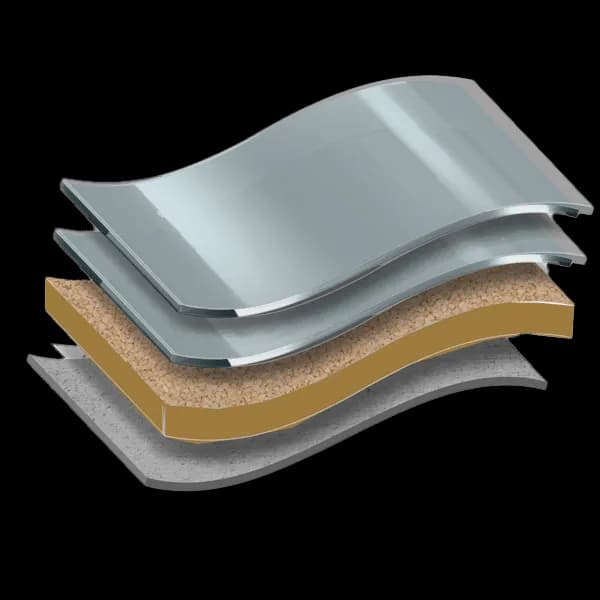

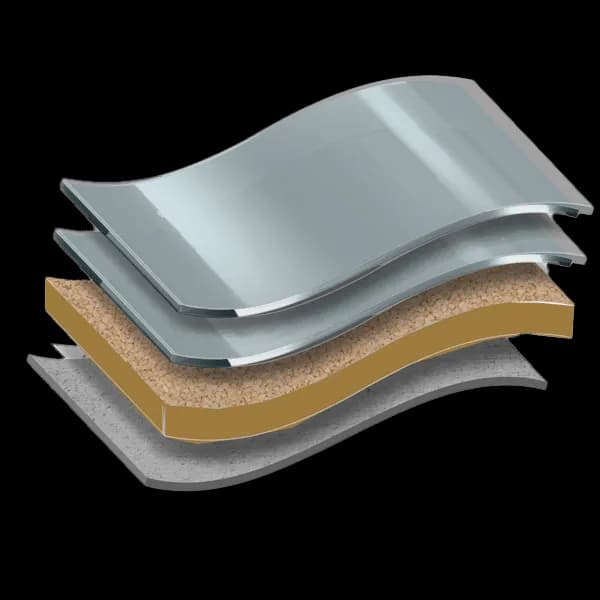

The catalog spans multiple system families that installers mix and match for thickness, texture, and chemical resistance. Expect primers, broadcast quartz or flake, self‑leveling epoxies, fast‑cure polyaspartics, MMA for cold returns, and urethane cement for thermal shock. Accessory SKUs include crack repair, cove base, and moisture mitigation.

Rough scale of offering

Across those families, the total SKU count looks to be in the dozens. Product categories sit in the low single digits, centered on resinous flooring types rather than adhesives or tile setting. That concentration is a strength for messaging, since buyers remember simple portfolios.

Want the latest EPD news?

Follow us on LinkedIn to get relevant updates for your industry.

EPD coverage today

As of December 8, 2025 we do not see current, publicly posted EPDs for Crown Polymers’ key flooring systems. That means architects and GCs targeting carbon‑forward specs will often default to brands with product‑specific, third party verified declarations. In LEED v5 draft language, product‑specific EPDs remain a preferred proof point for materials credits, so being absent can become a quiet filter long before price is discussed.

Why that gap matters commercially

When a project team cannot find a product EPD, they frequently model impacts using conservative assumptions. That pushes comparative carbon higher on paper and makes substitution more likely in late design. It is like showing up to a playoff game without a jersey number. Even if performance is great, it is harder to get picked.

Likely bestseller without an EPD, and what competitors show

Urethane cement flooring for food and beverage plants is a probable volume driver for Crown, given the market’s need for hot‑wash, chemical, and impact resistance. Several direct competitors publish EPDs for comparable systems. Examples include Dur‑A‑Flex Poly‑Crete systems verified by UL, Stonhard Stonclad UR and related components verified by Smart EPD, and Sika ComfortFloor systems verified by NSF. A specifier looking at those side‑by‑side can shortlist faster when an EPD is available for apples‑to‑apples review.

Typical competitors on the bid list

Crown Polymers most often runs into Stonhard, Dur‑A‑Flex, Flowcrete within Tremco CPG, and Sika in resinous flooring. In some facilities, alternatives from Sherwin‑Williams High Performance Flooring or Tennant Coatings also appear. For pharma, healthcare, and education, the matchup often pivots on EPD presence plus installation support and cure schedule.

Fastest route to credible EPDs

Focus on the workhorse systems first. One epoxy broadcast system, one self‑leveling epoxy, one polyaspartic topcoat, and one urethane cement family covers the majority of bids. Pick the PCR used by the competitors specifiers already trust, select a program operator aligned to target markets, and assemble one clean reference year of plant data. The heavy lift is data wrangling across purchasing, utilities and production, which is where a white‑glove LCA partner saves weeks so teams keep the line running.

What good looks like next quarter

Publish product‑specific EPDs for the urethane cement and a flagship epoxy system, then expand to fast‑cure and decorative quartz. Keep the set tight and clearly mapped to system guides so reps know which declaration to hand over in seconds. Once that is live, leverage it in submittal packages and distributor training. This is definitley about revenue enablement as much as reporting.

Frequently Asked Questions

Does Crown Polymers operate mainly in resinous flooring or across multiple finishing categories?

They focus on resinous flooring systems for commercial and industrial environments, rather than a broad set of finish materials.

Roughly how many product categories and SKUs does Crown Polymers offer?

Product categories are in the low single digits centered on resinous floors, with total SKUs in the dozens.

Do Crown Polymers’ core systems currently have publicly available EPDs?

As of December 8, 2025 we do not see current, publicly posted EPDs for their key systems.

Which competitors in resinous flooring commonly publish EPDs?

Dur‑A‑Flex, Stonhard, Flowcrete within Tremco CPG, and Sika frequently publish EPDs for epoxy, urethane cement, and related systems.

What is the fastest path to initial EPD coverage for a resinous flooring maker?

Start with the highest volume systems, choose the most commonly used PCR in your spec market, and organize one full reference year of plant data for third party verification.