Steel EPDs: what matters and why now

Specifiers are asking for a steel EPD and they want it yesterday. If your product lives in beams, HSS, plate or rebar, a clear declaration can unlock bids where embodied carbon is a pass or fail. Here is the fast, factual playbook to answer every "epd for steel" question without spinning your wheels.

What a steel EPD actually covers

A steel EPD reports a life‑cycle snapshot, usually cradle‑to‑gate. That means raw materials and energy for making steel and mill processing are counted as A1 to A3. Some declarations also add transport to site (A4), installation (A5), end‑of‑life stages (C1 to C4), and the circularity credit called Module D. Think of it like a movie trailer that shows the important scenes, not the entire film.

Which rulebook applies to steel

Most construction steel EPDs follow EN 15804 through a program operator’s PCR for construction products. Many operators publish complementary PCRs for structural steel and reinforcing bar that add steel‑specific rules. Teams typically pick the PCR that peers already use so results compare cleanly in procurement. The operator can be Smart EPD in the U.S. or IBU in Europe, among others. The key is third‑party verification and an up‑to‑date PCR.

The headline metric buyers check first

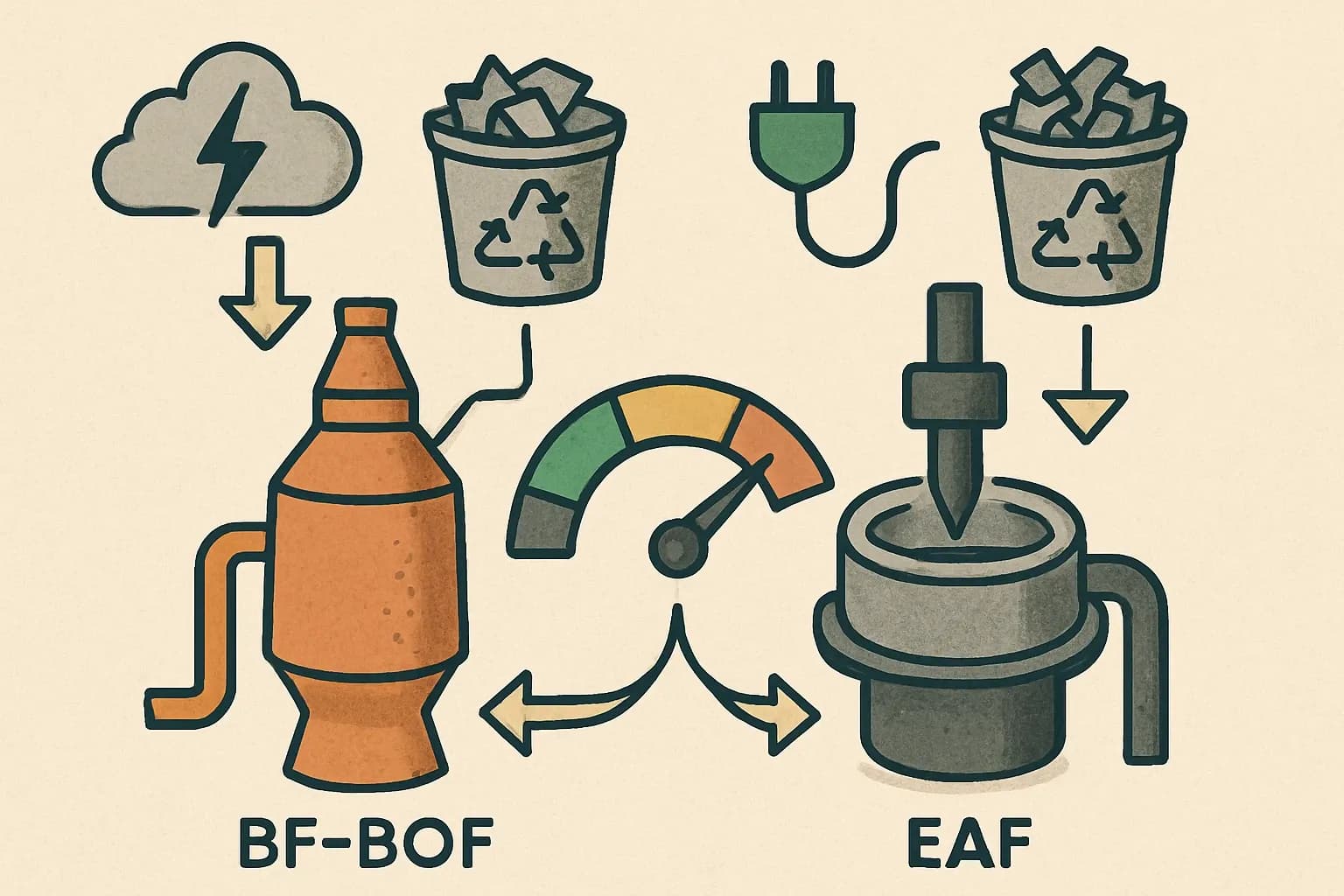

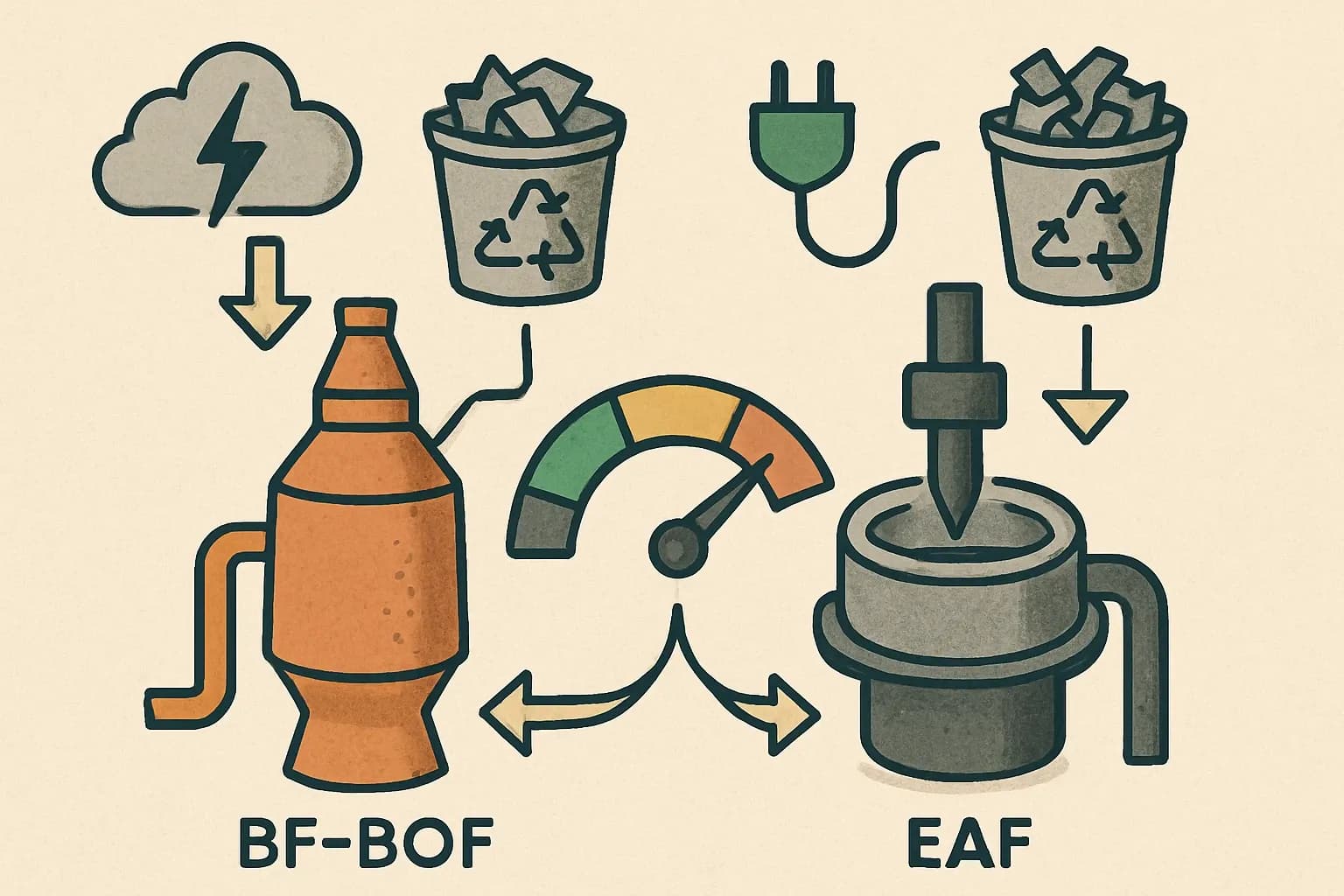

Global Warming Potential per unit mass is the scoreboard number. Route and power matter. Basic oxygen furnace on coal generally lands higher than electric arc furnace on recycled scrap, especially with low‑carbon electricity. The iron and steel sector accounts for roughly 7 to 8 percent of global energy‑system CO2, which is why attention is intense (IEA, 2024; OECD, 2025).

Real thresholds you will see on bids

California’s Buy Clean sets maximum cradle‑to‑gate GWP for state projects. Current limits include 1,010 kg CO2e per tonne for hot‑rolled structural sections, 1,710 for HSS, 1,490 for plate, and 890 for concrete reinforcing steel. Fabricated‑product checks use A1 only, with corresponding ceilings published by the state (California DGS, 2025). These numbers are not abstract. They decide eligibility on day one. (California DGS, 2025)

How long a steel EPD stays valid

Across EN 15804 programs an EPD typically carries a five‑year validity window before renewal. That timing is set during verification and printed in the declaration so you can plan refresh work well ahead of key pursuits (EPD International, 2025). (EPD International, 2025)

Need to stand out in steel tenders?

Follow us on LinkedIn for data-driven insights that help you get spec'd and unlock new opportunities.

What to prepare without boiling the ocean

Collect one recent full production year. Pull melt shop and finishing energy, alloy and flux inputs, scrap ratios, off‑site processing, transport distances, yield losses, and the electricity mix by facility. Capture fabrication steps if you sell fabricated components. Keep bills of materials, utility invoices, and ERP exports handy. Small teams can move fast when data owners see exactly what is needed and nothing more.

Module D and recycled content, without the myths

Module D reports the avoided impacts from scrap that re‑enters the next product system. It is useful context, yet procurement usually compares A1 to A3 or A1 only against a threshold. Do not rely on D to pass a limit that is set on the cradle‑to‑gate number. Recycled content still matters, especially when paired with cleaner electricity. It is the classic two‑key turn.

Picking a program operator for steel

Choose the operator your target market and customers recognize, then check two things. First, does their PCR align with EN 15804 +A2 and your product scope. Second, are they comfortable publishing facility‑specific EPDs if a bid requires them. Operators differ on templates and tooling, yet the essentials are shared. We care about speed, ease, and verification depth because your spec window is short.

Where the ROI shows up

Many public owners and a growing share of private ones are screening steel with GWP caps. Projects using LEED v5 draft frameworks weigh embodied carbon more centrally than before, which elevates product‑specific EPDs in submittals. If your EPD makes you eligible, you get in the room on value, not price alone. One midsized win can eclipse the cost of the declaration, and that is not hyperbole, it is math.

Common pitfalls that slow steel EPDs

Use a facility‑specific EPD when a bid or state rule asks for it. Match your declared unit to what buyers need, usually 1 metric tonne. If you fabricate, make sure the rules clarify whether A5 is required. Avoid double counting D. Finally, track PCR revision dates so your renewal does not trip on a silent rule change. It sounds fussy, but it saves bids.

What “good” looks like for a steel EPD

Clear scope, recent data, verified results, and numbers that stand next to peers in the same PCR. If your GWP already beats local caps with margin, say it plainly. If you are close, map the smallest operational levers to close the gap, like power contracts or yield improvements. That is how a steel EPD stops being paperwork and starts being a growth asset. And yes, it is definately doable.

Frequently Asked Questions

Do buyers compare steel EPDs on A1 to A3 or A1 only?

It depends on the rule. Threshold programs like California’s fabricated checks use A1 only, while most cradle‑to‑gate comparisons use A1 to A3. The published bid documents decide the frame (California DGS, 2025).

How often should we refresh production data in an active EPD?

The EPD stays valid for its five‑year window, but many teams update earlier when electricity mix or scrap share shifts materially so submittals reflect current performance (EPD International, 2025).

What size unit should we declare for steel?

One metric tonne is typical for structural shapes, HSS, plate, and rebar. Keep secondary units consistent with your price lists to simplify takeoffs.