Canada’s gypsum board market and EPD coverage

If you sell gypsum board into Canadian projects, your spec chances rise when your SKUs have current, product‑specific EPDs. This quick briefing shows who leads the market and where their EPD footprint is strongest today, plus how to close any gaps fast without drowning your team in spreadsheets.

The Canadian field at a glance

Canada’s gypsum board supply is consolidated around five names that most specifiers recognize. CGC Inc. (USG in Canada), CertainTeed Gypsum Canada, National Gypsum, Georgia‑Pacific, and Quebec‑based Gypsemna. The first four operate multiple North American plants and distribute broadly in Canada. Gypsemna focuses on domestic production and regional distribution.

Where EPD coverage stands by brand

-

CertainTeed Gypsum: Broad product‑specific coverage, including glass‑mat sheathing and Type X families, with EPDs published by major operators in recent cycles. The company also highlights facility‑specific transparency and an LCA Action Plan for its Montreal drywall plant, a useful signal for project teams seeking plant‑referenced data (CertainTeed, 2025).

-

USG and CGC: A wide slate of gypsum panel EPDs is published with ASTM as program operator. These listings span core interior boards and glass‑mat offerings, with current documents visible in the ASTM catalog (ASTM, 2025). (ASTM, 2025)

-

National Gypsum: Multiple plant‑specific EPDs for Gold Bond boards, with recent declarations running from May 23, 2025 to May 23, 2030, which aligns with typical five‑year validity periods across programs (NSF, 2025). (NSF, 2025)

-

Georgia‑Pacific: Fresh EPDs are available for DensDeck roof boards with validity from August 8, 2025 to August 8, 2030. That is a different application than interior wallboard yet it shows active program engagement and current disclosures for gypsum‑based panels (NSF, 2025). (NSF, 2025)

-

Gypsemna: As of November 27, 2025, we could not confirm public, third‑party verified EPDs for common interior board SKUs. If you have a link we missed, send it our way and we will update.

Want the latest EPD news?

Follow us on LinkedIn to get relevant updates for your industry.

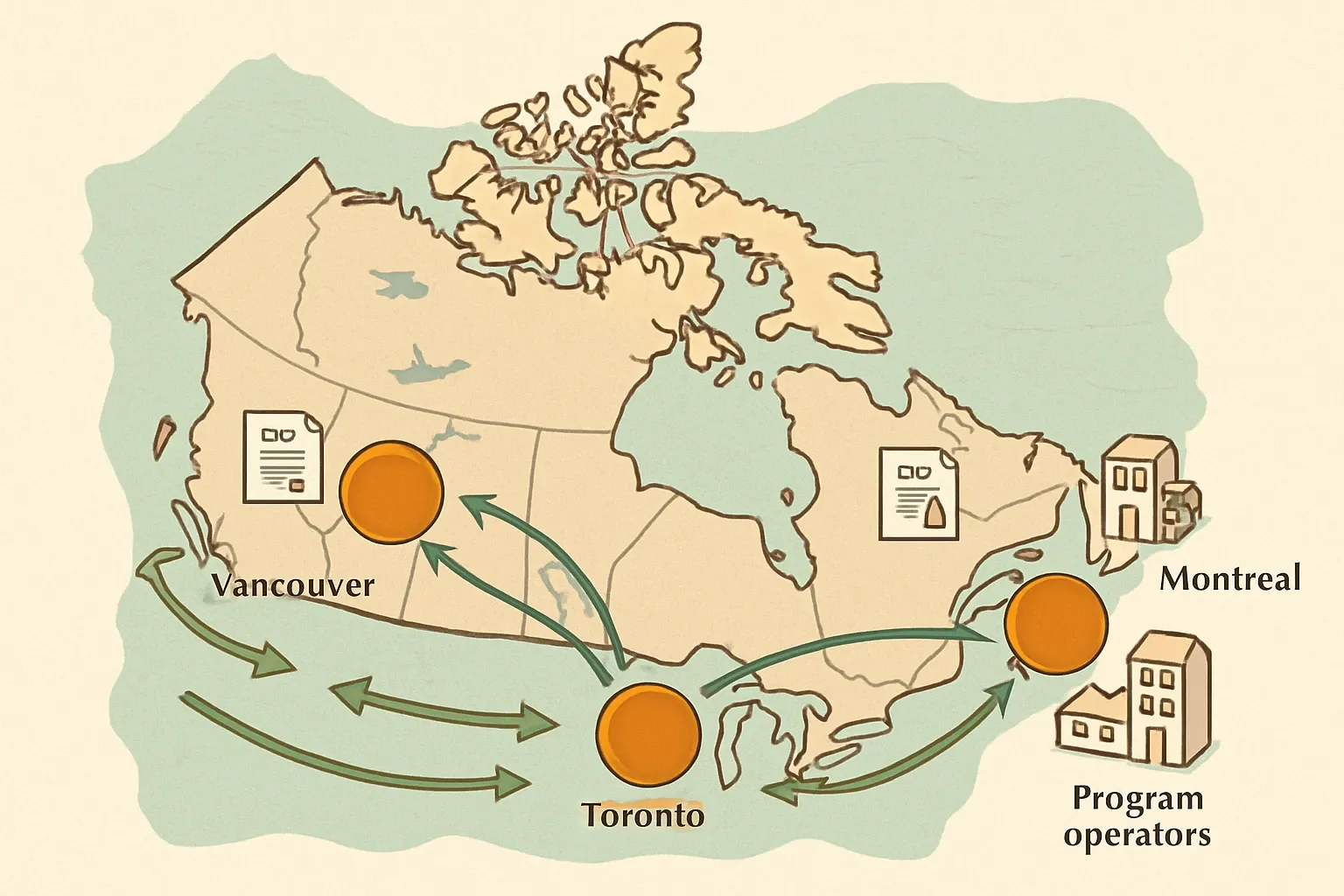

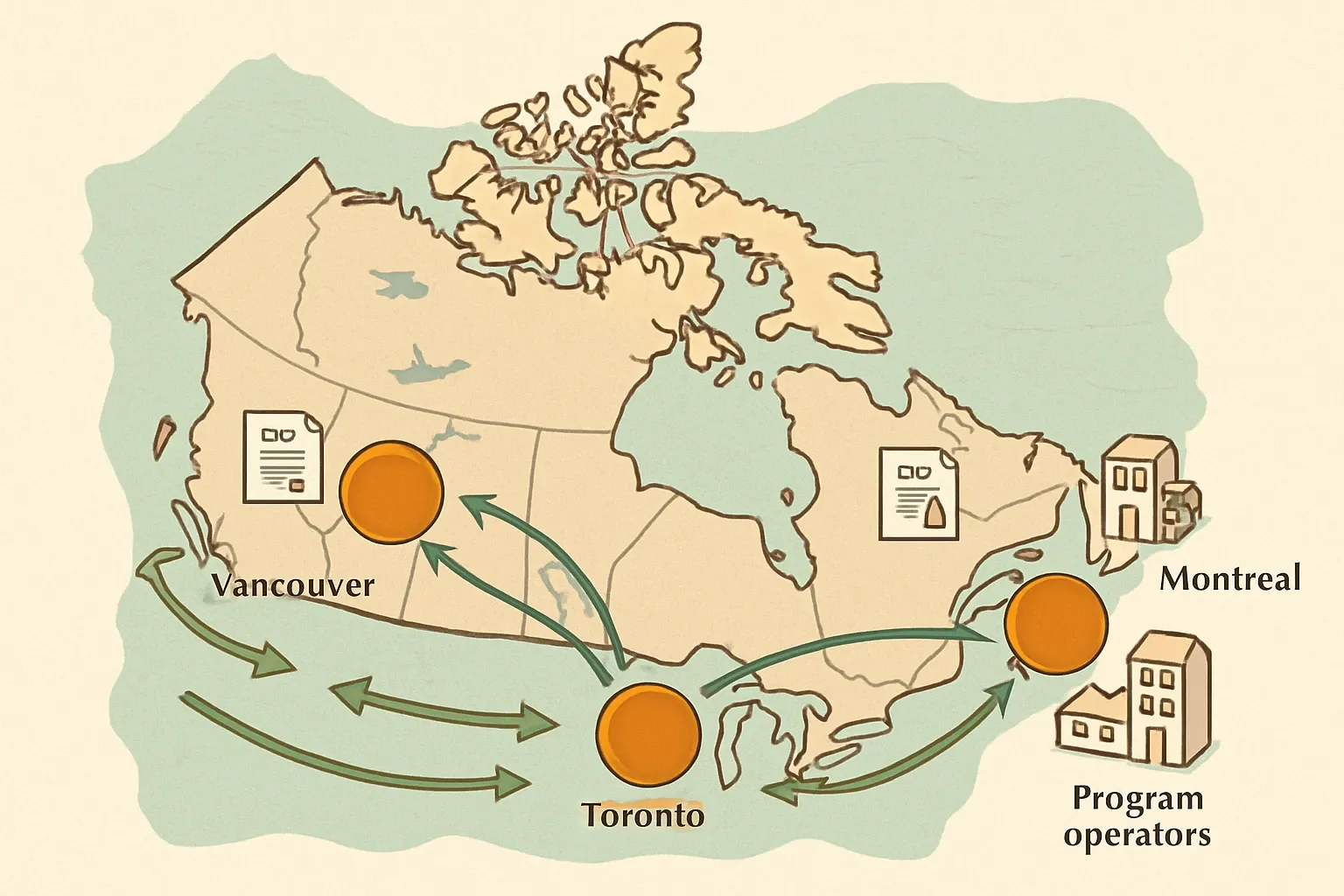

Program operators and the PCR that sets the rules

You will see gypsum board EPDs in North America issued by ASTM, UL Solutions, NSF, and Smart EPD. The current Part B PCR for gypsum panels was updated in 2025 by Smart EPD, which many new declarations reference for methods and reporting scope (CLF, 2025). Recent gypsum board EPDs often carry five‑year validity windows, for example National Gypsum and Georgia‑Pacific entries that run through 2030 (NSF, 2025).

Why this matters commercially

Projects in Canada increasingly prefer product‑specific, third‑party EPDs because they remove carbon accounting penalties that apply when only generic data is available. With a current EPD, your product is easier to compare and more likely to stay in the spec during late‑stage value engineering. Teams also avoid last‑minute data scrambles during submittals.

How manufacturers close EPD gaps without slowing operations

-

Pick the right PCR and operator first. A good LCA partner will benchmark competitors, check program operator fit for your target markets, and recommend the path that reduces friction for submittals.

-

Demand white‑glove data capture. The fastest programs do not ask your plant team to become LCA pros. They run the interviews, pull utility and mass‑balance data from your systems, and keep R&D and operations focussed on production.

-

Start portfolio logic on day one. Prioritize highest‑volume SKUs and glass‑mat lines that appear on many envelopes. Expand to variants in a planned batch so you avoid re‑collecting plant data twice.

-

Use plant‑referenced EPDs where you can. They travel better across provincial and municipal low‑carbon requirements and simplify conversations with owners and GCs.

Practical watch‑outs for Canada

-

Western Canada has ongoing trade measures on certain US gypsum board imports, which can affect landed cost and lead times. That makes local plant EPDs and resilient supply even more valuable in bids (Canadian International Trade Tribunal, 2022; CBSA, 2022).

-

Many owners now ask for digital submittals. Ensure your EPD PDFs include machine‑readable appendices where available and that SKUs, plant names, and validity dates are clearly mapped in your PIM or ERP so sales can quickly produce project‑specific packs. Do not make the team hunt for files they can’t easily recieve.

Bottom line for 2026 specs

If you are CertainTeed, USG‑CGC, or National Gypsum, you already have a strong EPD bench to win Canadian work. If you are scaling or re‑entering, move fast on product‑specific, plant‑referenced EPDs for your top five SKUs, then roll to the rest in planned batches. Choose a partner that handles the heavy data lifting so your experts stay on line uptime and product quality, while your EPDs arrive in weeks and not quarters.

Frequently Asked Questions

Do Canadian bid teams really prefer product-specific EPDs over industry-average documents?

Yes. Product-specific EPDs avoid conservative assumptions that can add a carbon penalty in whole‑building calculations. This increases your chance of staying in the spec when low‑carbon targets are enforced.

What is the typical validity period for gypsum board EPDs in North America?

Five years is common. For example, National Gypsum and Georgia‑Pacific gypsum panels show validity from 2025 to 2030 on recent listings (NSF, 2025). (NSF, 2025)

Which PCR should we expect for North American gypsum panel EPDs going forward?

Many new EPDs reference Smart EPD’s 2025 Part B PCR for gypsum panels, used with a Part A framework. It standardizes methods and reporting that specifiers rely on (CLF, 2025).