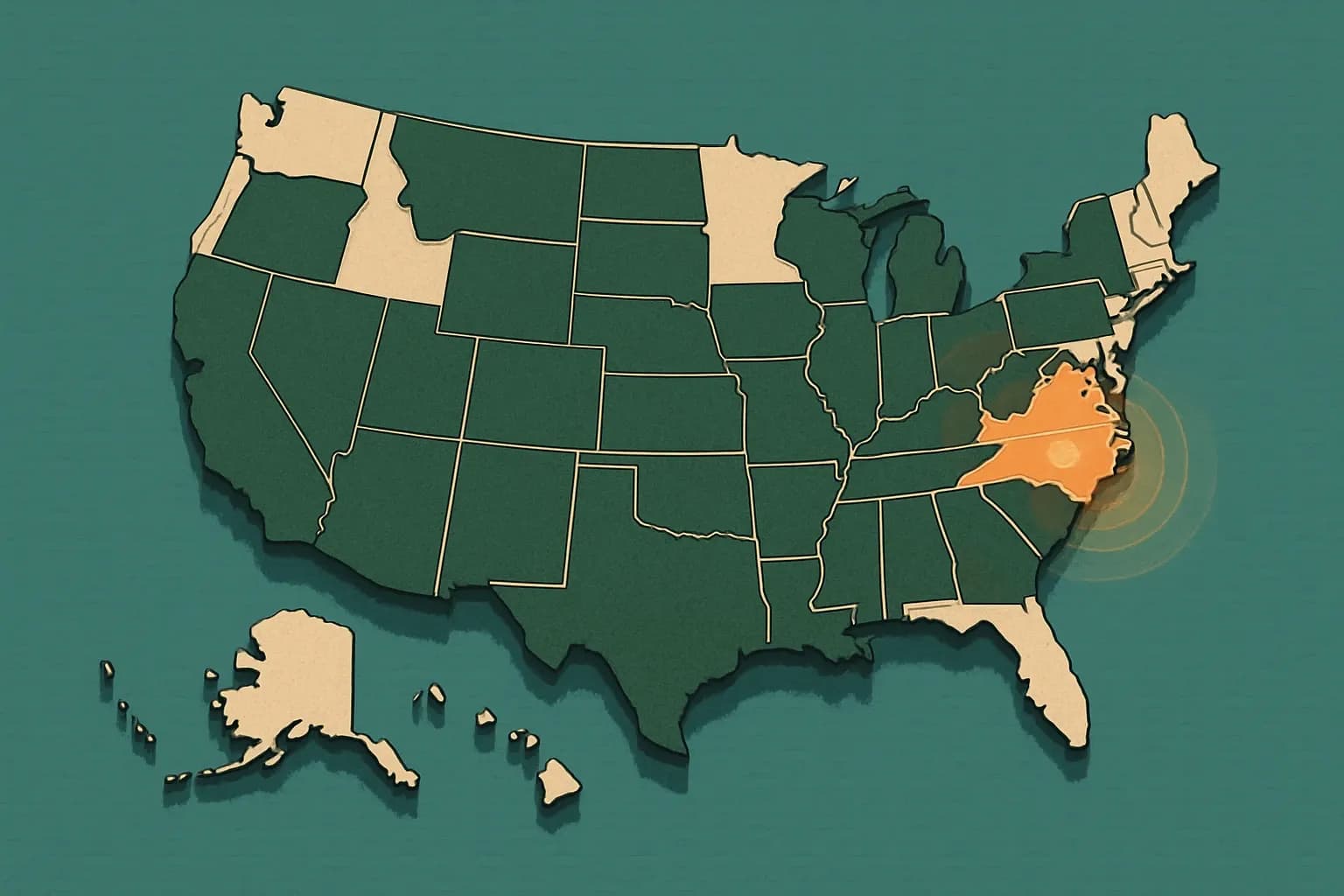

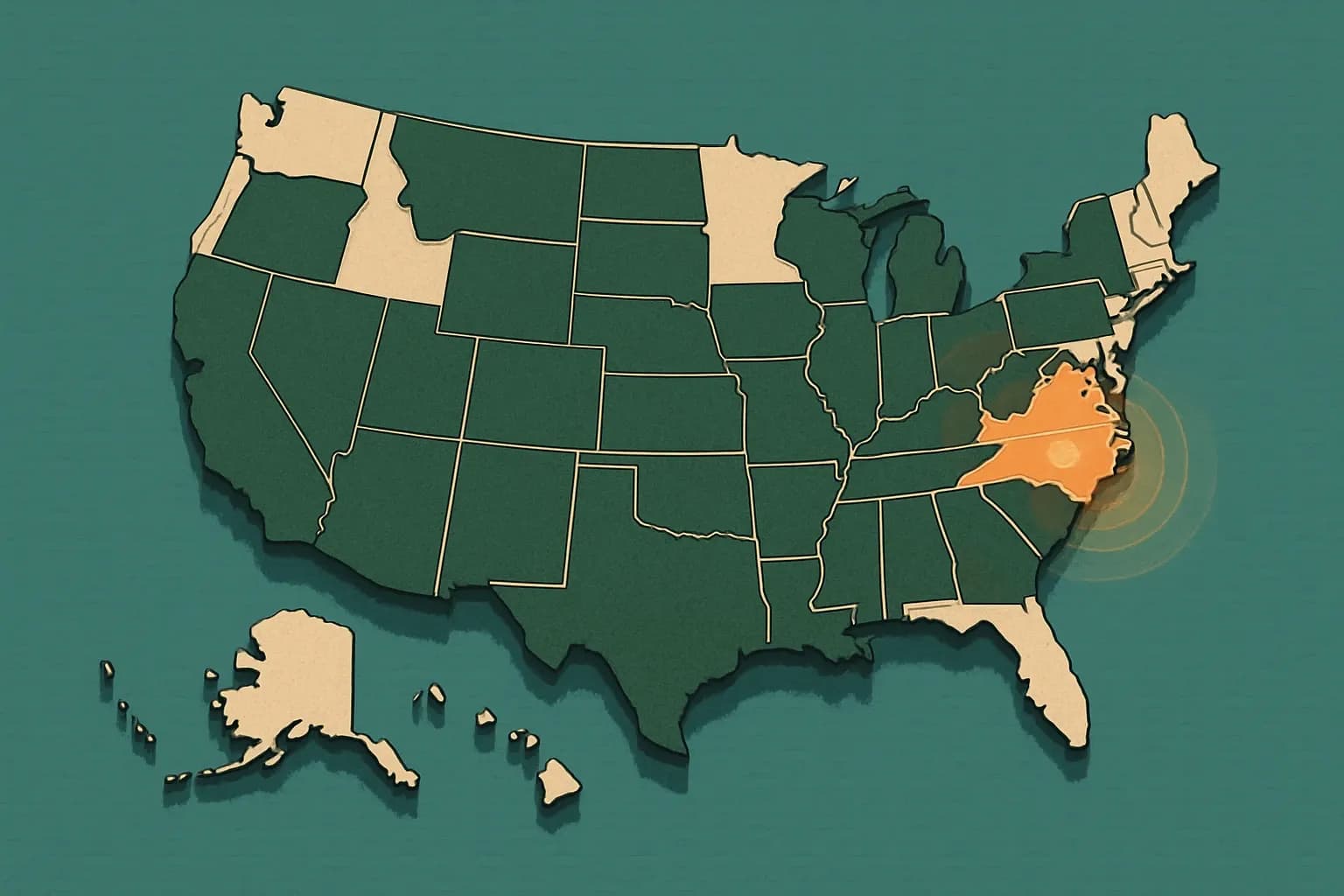

Virginia Asphalt Recycling Tax Credit: EPD Upside

A 20 percent tax credit on asphalt-recycling machinery sounds nice. Match it with a carbon-smart EPD and you can win more DOT bids, trim raw-material costs, and bank reputational cred—all before the roller cools.

The bill in 60 seconds

Virginia House Bill 2740 would grant a non-refundable income-tax credit equal to 20 percent of the purchase price of certified asphalt-recycling equipment bought in 2025 or 2026 (Virginia HB 2740, 2025). The cap is $3 million statewide per year and 40 percent of any single taxpayer’s liability. Unused credits roll forward for a decade.

Money on the table: quick math

Spend $2 million on a mobile cold-in-place recycling train. You pocket a $400 k credit, plus cut hauling and virgin-aggregate costs by roughly $5 to $7 per ton of mix (FHWA, 2024). That margin sweetener often dwarfs the capital outlay within two paving seasons.

Why recyclers should care about EPDs

Departments of Transportation in Colorado and California already collect asphalt EPDs as a condition of award (CDOT, 2025; Caltrans, 2025). Virginia is watching. An EPD that reflects RAP savings puts a hard number on your carbon cut, letting you score on green-procurement rubrics instead of arguing by PowerPoint.

Want to win more DOT bids with EPDs?

Follow us on LinkedIn for insights on leveraging tax credits and EPDs to unlock new business opportunities.

Capturing lower carbon in your LCA

Using 22 percent reclaimed asphalt pavement avoids roughly 2.9 million t CO₂e nationwide (NAPA SIP-111, 2025). Fold that into Module A1 of your LCA and watch the Global Warming Potential drop like a pothole patch in July heat. Just be sure the PCR for asphalt mixtures lets you credit recycled binder and aggregate correctly.

How the credit fits state procurement trends

Virginia’s own DEQ and VDOT run pilot projects tracking embodied carbon. When those specs ripple into bid docs, suppliers with fresh, third-party verified EPDs will clear pre-qualification hurdles faster than rivals still chasing spreadsheets.

Eligible equipment and certification hurdles

The Department of Environmental Quality must certify that your mill, pugmill, or heater-planer is “integral to the recycling process.” Submit make, model, serial, and process flow. Approval can lag 60 days, so order paperwork the same week you order the machine.

Quick checklist before claiming

- Verify the purchase date falls between Jan 1 2025 and Dec 31 2026.

- Obtain DEQ certification letter.

- Collect invoices showing capitalized cost, excluding interest.

- File Form 500CR or Schedule CR with your 2025/26 return.

- Start the LCA data pull now so the next paving season’s mixes ship with an EPD.

Bottom line for manufacturers

HB 2740 lowers the cash barrier to buy gear that slashes carbon and cost. Pairing that hardware with an up-to-date asphalt EPD turns the tax perk into a full-blown market advantage. Miss the two-year window and you may spend alot longer explaining why your mix still needs virgin rock.

Frequently Asked Questions

Does the 20 percent Virginia credit stack with federal depreciation incentives?

Yes. HB 2740’s credit applies to state income tax while federal MACRS depreciation and Section 179 expensing continue to apply at the federal level. Check with a tax advisor to optimize timing.

Must the recycling equipment be used exclusively in Virginia to qualify?

The bill language focuses on processing asphalt materials "in the Commonwealth." Occasional out-of-state jobs likely will not nullify the credit, but primary use should be within Virginia (Virginia HB 2740, 2025).

Can I claim the credit and still lease the equipment?

Only the purchaser who capitalizes the asset may claim the credit. Operating leases generally do not qualify because no purchase price is recorded.

Will my existing asphalt EPD automatically improve after I buy recycling gear?

Not automatically. You need a new LCA using production data that captures RAP percentages achieved with the new equipment, then a third-party verifies and publishes the updated EPD.