Resinous Flooring, Hyperscalers and EPDs

If you make epoxy, polyurethane or urethane‑cement floors, the biggest project of your career may be an AI data center you never step foot in. Whether your systems carry product‑specific, third‑party EPDs increasingly decides if you are on the shortlist or invisible.

Why data centers suddenly matter to floor manufacturers

Here is the short version. Data center buildouts have broken out of the niche and into national infrastructure scale. U.S. construction spending tied to data centers reached about 40 billion dollars annualized in mid 2025, a record tied to AI demand (Reuters, 2025). ConstructConnect tracked roughly 20 billion dollars across 19 U.S. data center projects scheduled to start within six months, illustrating the pipeline breadth (ConstructConnect News, 2025). In EMEA, operators reported about 10.3 GW live, 2.6 GW under construction and 11.5 GW in planning, a 43 percent year-over-year pipeline jump that signals a sustained multi-year cycle (Cushman & Wakefield, 2025).

This article quantifies what is at stake for resinous flooring, shows where these systems actually appear inside data centers, explains why EPDs moved from nice-to-have to non-optional, and gives a practical plan to prioritize which products to put through EPDs first.

Four mega projects, one lesson

The projects below are not outliers. They are bellwethers that set expectations for size, phasing and procurement discipline.

Meta AI Data Center, Louisiana

Meta announced a 10 billion dollar AI data center campus in Richland Parish, described by the state as the company’s largest data center investment to date (Louisiana Governor Press Office, 2024). Trade coverage points to roughly 4 million square feet on about 2,250 acres with phased buildout tied to AI capacity ramps, which means multiple bid windows for finishes like floors as buildings sequence in over time (DatacenterDynamics, 2024, Data Center Frontier, 2024).

Why it matters for floors. The campus scale and phasing translate to repeat opportunities across battery rooms, generator spaces and white space. Resinous systems win where static control, chemical resistance and fast return to service matter most.

Vantage “Frontier” AI Campus, Texas

Vantage outlined a 25 billion dollar, 1.4 GW hyperscale campus in Shackelford County with about ten data centers totaling approximately 3.7 million square feet on 1,200 acres, engineered from the start for AI workloads (DatacenterDynamics, 2024, Construction Review, 2024, TeckNexus, 2024).

Why it matters for floors. AI loads concentrate power and battery infrastructure. That raises the value of high performance resin systems in mechanical and energy storage areas, plus ESD-oriented systems in data halls.

Want the latest EPD news?

Follow us on LinkedIn to get relevant updates for your industry.

Amazon AWS AI campuses, Pennsylvania

State officials announced at least 20 billion dollars in AWS investment across multiple AI and cloud “innovation campuses”, billed as the largest capital investment in Pennsylvania’s history (Pennsylvania Governor’s Office, 2025, About Amazon, 2025). Early sites include Salem Township and Falls Township with additional locations under evaluation (AP News, 2025).

Why it matters for floors. Multi-site programs standardize specification. Suppliers with ready EPDs for the required system types enter those standards discussions with leverage.

SINES DC, Start Campus, Portugal

Start Campus is developing a 1.2 GW coastal campus at Sines marketed as one of Europe’s largest AI and cloud hubs. Planned investment is about 8.5 billion euros for six buildings, with one already in service and more in planning and construction phases (Reuters, 2025). The program advertises grid and renewable integration that attract AI tenants, which tends to accelerate fit-out cycles, not slow them.

Why it matters for floors. Large, staged buildings with demanding uptime targets favor fast curing, low VOC systems and proven chemical resistance where spills happen.

You could add Project Sail in Georgia, a roughly 17 billion dollar, 4.3 million square foot program, to make the point that campus-scale is the new normal rather than a one-off (Financial Times, 2025). ResearchAndMarkets tracked a global pipeline nearing one trillion dollars in large data center construction projects, again signaling that scale is structural, not episodic (BusinessWire, 2025).

What a single hyperscale campus can mean for resin floors

Let’s run conservative, clearly labeled scenarios to translate area into revenue. These are not official figures for any specific project. They are planning-level ranges to help product and sales teams set priorities.

Scenario inputs for a 3.7 to 4.0 million square foot campus, similar to the Vantage example above. Assume between 25 and 50 percent of the built area ultimately receives resinous flooring across data halls, subfloor slabs, corridors, battery and generator rooms, UPS rooms and selected support spaces. That produces a range of roughly 0.9 to 2.0 million square feet of coated floor, acknowledging that actual percentages vary by design and operator preference. Conservatively assume total installed cost of 5 to 8 dollars per square foot for mission-critical resinous systems in these environments, inclusive of prep and labor. Readers should cross check with their pricing and contractor partners given local market differences.

| Campus example | Estimated resin floor area (sq ft) | Installed cost / sq ft | Approx. total installed flooring value | Rough material share (40–60 %) | Ballpark manufacturer revenue |

|---|---|---|---|---|---|

| Meta Louisiana | 1.0–1.5 M | 5–8 dollars | 5–12 M dollars | 40–60 percent | 2–7 M dollars |

| Vantage Frontier | 1.0–2.0 M | 5–8 dollars | 5–16 M dollars | 40–60 percent | 2–10 M dollars |

| AWS PA campuses, per campus | 0.5–1.0 M | 5–8 dollars | 2.5–8 M dollars | 40–60 percent | 1–5 M dollars |

Even if resinous flooring only covers a portion of a campus, one hyperscale project can translate into low to mid seven figure material sales for a manufacturer. That is the order of magnitude to keep in mind when you weigh the cost and speed of creating EPDs.

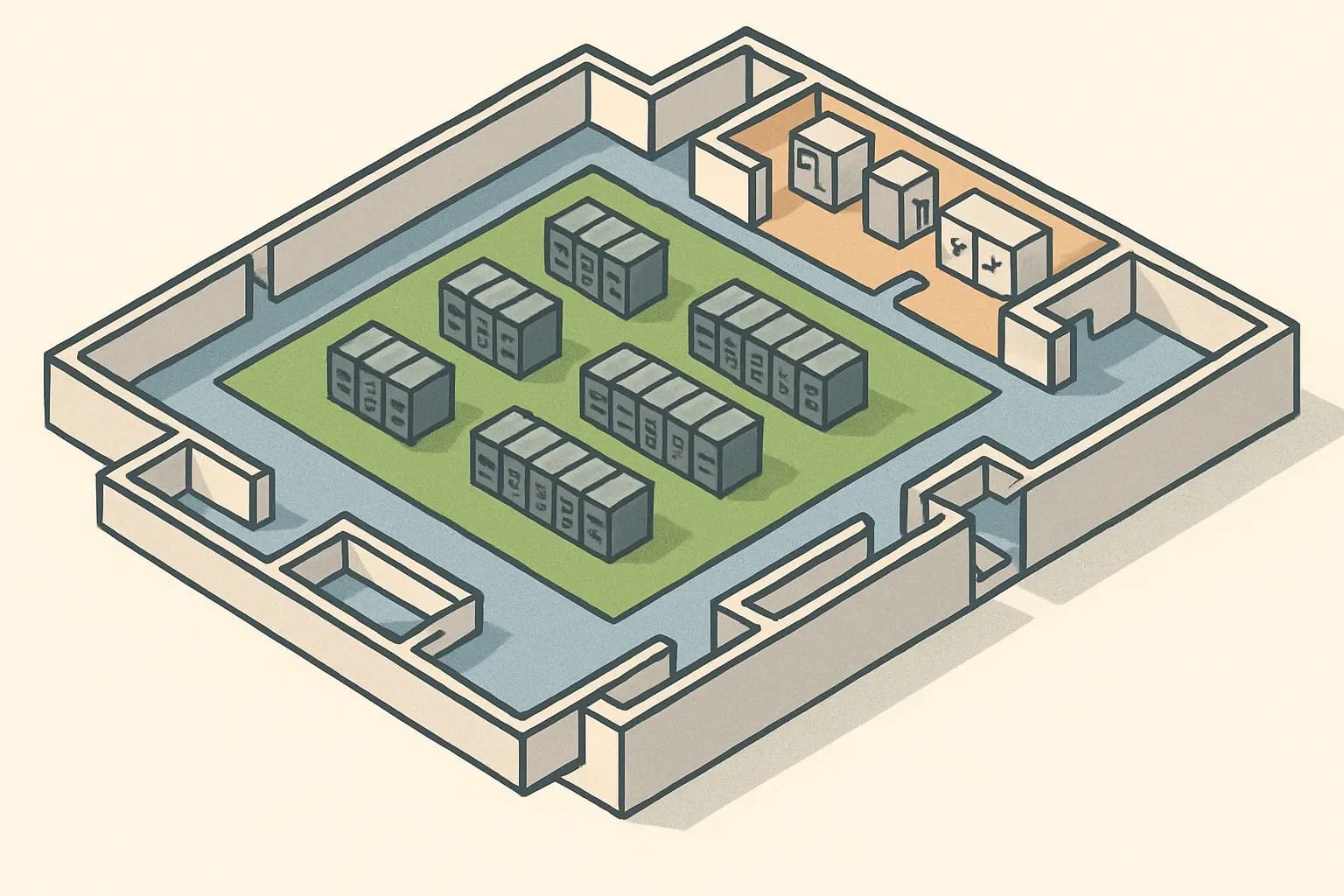

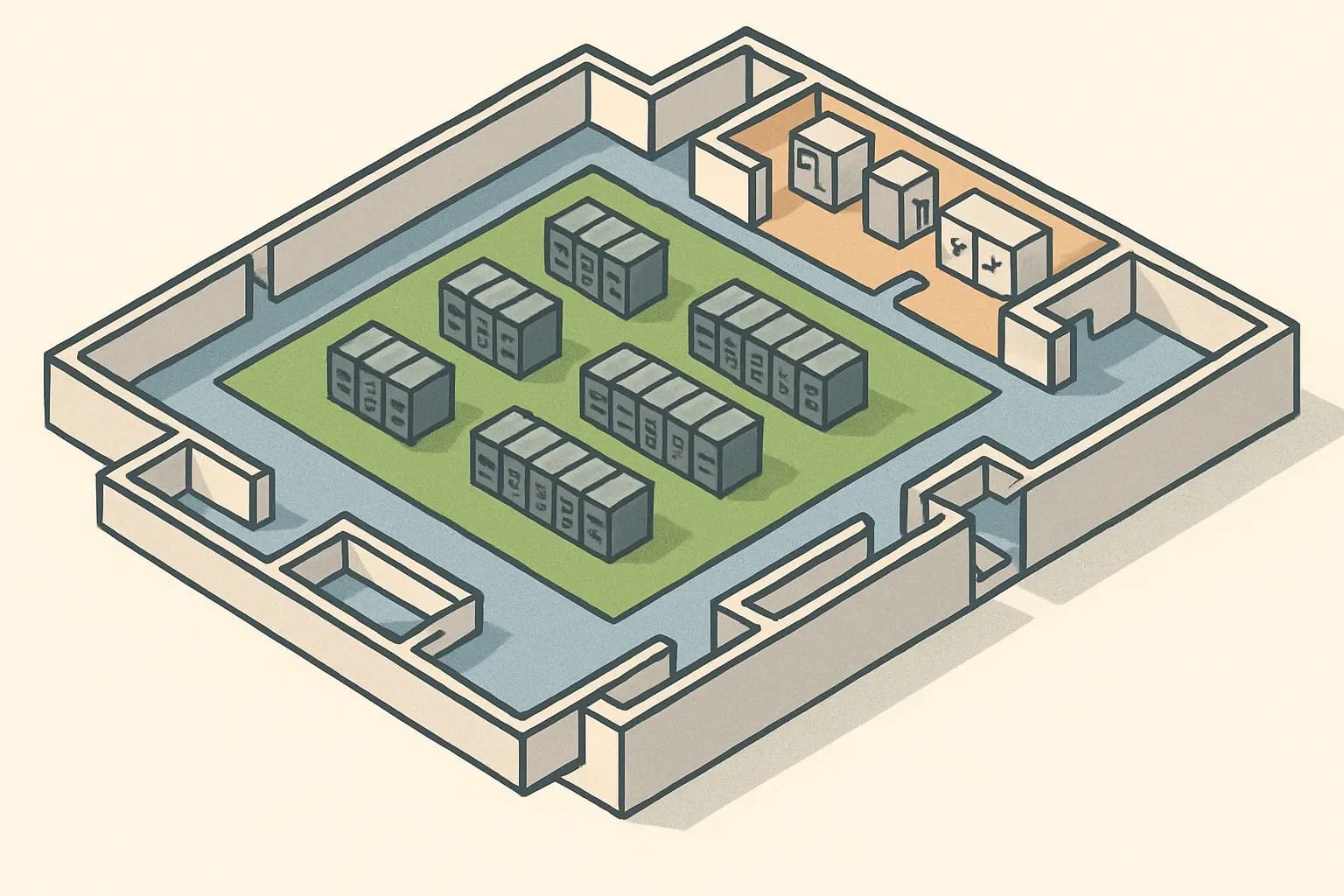

Where resinous flooring actually shows up in data centers

Not every square foot is resinous. Raised access floors with HPL or vinyl, resilient tile and rubber are common in some data halls and offices. The slab under raised floors is often treated or coated for dust, moisture and static control, which still puts resin systems in play.

The locations that consistently point to resinous systems group into three buckets.

Bucket 1, ESD and anti-static epoxy or urethane systems

Purpose. Control static in server halls, hot and cold aisles, control rooms and on subfloor slabs under raised access floors when owners want an engineered path to ground. Manufacturers and contractors describe data centers and server rooms as core ESD applications because the risk and consequence of discharge are high. This is where product-specific EPDs make selection easier for specifiers who are building embodied carbon models alongside performance models.

Bucket 2, heavy duty chemical resistant systems, epoxy and urethane cement

Purpose. Protect battery rooms, UPS rooms, generator rooms, fuel storage and oil-exposed mechanical spaces from sulfuric acid, electrolytes, fuels and lubricants. Urethane cement mortars, novolac and other chemical resistant epoxies, and broadcast systems with textured topcoats are frequently selected because they combine resistance, cleanability and durability at thicknesses that handle heavy loads. Operators value wash down compatibility and slope to drain details that pair well with these systems.

Bucket 3, low VOC, fast curing systems, epoxy, PU and polyaspartic

Purpose. Turn corridors, white space and support areas back to service in hours, not days, while keeping odors down near live gear. Polyaspartic and certain waterborne or 100 percent solids epoxies are often specified where staging and downtime dominate the cost calculus. This is also where early EPD coverage can see heavy usage across a campus.

Why hyperscalers suddenly care about EPDs

Operators have hammered operational energy for a decade. The next frontier is embodied carbon, especially in steel, concrete and heavy MEP. Case studies suggest that in some data center builds, materials like steel, concrete and cooling equipment account for about 70 percent of the building’s embodied carbon, which means progress requires product-level data, not only grid contracts (UBS and Datum case study, 2024).

Hyperscalers are running specific programs to knock embodied carbon down. Microsoft piloted cross laminated timber in data centers and reported 35 to 65 percent embodied carbon reductions against conventional structures where applicable, a powerful signal that embodied choices are squarely in scope (Microsoft, 2024). Meta has documented the use of lower carbon concrete mixes in data centers, again pointing to material substitution grounded in measured data rather than slogans (Meta Sustainability, 2024). AWS publicized an agreement to use fossil free steel for data center components as part of its supply decarbonization approach (ESG Today, 2024).

Industry leaders have also framed embodied carbon as the “hidden” but critical part of a data center’s footprint and urged suppliers to put numbers on the table so project teams can model like for like. Schneider Electric summarized the challenge and pathway in a widely shared post, and Equinix called embodied carbon the unseen emissions enterprises cannot ignore in procurement cycles (Schneider Electric, 2022, Equinix, 2025).

The turning point for suppliers came with the iMasons Climate Accord open letter in July 2024. The governing body, including AWS, Google, Meta, Microsoft, Digital Realty and Schneider Electric, called on suppliers to provide Environmental Product Declarations to support Scope 3 accounting in digital infrastructure. It reads like a procurement signal, not a PR flourish, and it makes the expectation plain: if you supply into these builds, bring product specific, third party verified EPDs so your products can be modeled credibly (iMasons Climate Accord, 2024).

What happens if a product has no EPD

Procurement and LCA workflows must still model the building. When a product lacks a product specific, verified EPD, assessors often reach for generic or industry average datasets as placeholders. Those placeholders are designed for coverage and comparability, not to showcase a given manufacturer’s formulation. In practice this can make a better than average product look average on paper.

Several practical issues follow. Designers sometimes substitute a competitor’s EPD with similar performance to improve the modeled embodied carbon. In comparative scoring, a bid without an EPD can look “dirtier” on the worksheet even when chemistries are comparable. Building Transparency’s guidance on uncertainty explains why product specific EPDs reduce uncertainty and why generic datasets inject wider ranges and conservative assumptions into global warming potential estimates, which is a disadvantage in tight comparisons (Building Transparency, 2023).

After the iMasons letter, EPDs are showing up as part of the checklist in data center RFPs. A supplier whose system cannot be modeled at the product level has a weaker position when hyperscalers compare carbon, cost and schedule in one view. Sustainable Solutions Corporation has put this plainly for data center supply chains, describing EPDs as the backbone of climate accountability in procurement and a competitive opportunity rather than pure compliance (Sustainable Solutions Corporation, 2025).

The ROI math for resinous flooring is not subtle

Consider a manufacturer that supplies one million square feet of ESD or chemical resistant flooring to a large campus at an average material price of 3 to 4 dollars per square foot. That is 3 to 4 million dollars in product revenue on a single program. Even a smaller share of 500,000 square feet at 3 dollars per square foot yields 1.5 million dollars in sales for one project.

EPDs require focus and specialist help, yet the financial comparison is simple. If an EPD effort runs in the low five figures for a single, well scoped product system, and that EPD helps win one additional large project, the payback is measured in orders of magnitude. It is common to see a 60 to 200 times return on the EPD effort when measured against material revenue on a single hyperscale win, and then the declaration continues to support bids for several years.

There is another benefit that is harder to price yet real. Once the data plumbing is in place across plants and formulations, subsequent EPDs for similar systems move faster and cheaper. Internal teams also avoid repeated ad hoc data calls. There are less time and budget surprises.

How to prioritize EPDs for data center relevance

Treat this as a product mapping exercise with a sales outcome.

-

Map your portfolio to the three data center buckets

Group SKUs and systems by use case. First, ESD and anti static epoxy or urethane systems for server halls, control rooms and subfloor slabs under raised floors. Second, chemical resistant epoxy and urethane cement systems for battery, UPS, generator and fuel handling spaces. Third, low VOC, fast curing epoxy, PU and polyaspartic systems for corridors, white space and other support areas where downtime rules the schedule. -

Pick 1 to 3 flagship systems per bucket

Select the systems that meet the widest set of data center performance requirements and that you are confident you can supply at scale. Document slip resistance, static control pathways, chemical exposure resistance, cure profiles and compatible prep. Mirror how major brands label their data center systems so specifiers can map requirements quickly, even if your chemistry is distinct. -

Audit EPD coverage and visible placement

Inventory what is already published and where. Publish new declarations with a recognized program operator in target markets. In the U.S. many suppliers rely on program operators that can publish quickly and integrate with the tools specifiers use. In Europe, IBU is commonly referenced and supports EN 15804. Make sure EPDs are discoverable on your website and present in public tools used by designers. If your EPDs are not visible in the databases and spec libraries where mission critical teams search, they may as well not exist. -

Sequence EPD creation by revenue impact

Start with the systems most likely to be specified in data centers. ESD and urethane cements usually hit early and often. Low VOC fast cure topcoats that turn corridors and white space quickly can unlock schedule value and show up across phases. Consider family or range level declarations where PCRs and operator rules allow similar formulations to be covered together. That approach can expand coverage without multiplying effort. -

Make it easy for specifiers to model your products

Pair each EPD with a short spec note that clarifies use case, cure windows, ESD path to ground, and chemical exposure ratings. Provide BIM objects and clear CSI MasterFormat placements. Make contact information for technical support obvious, because data center projects move quickly and approvals can be time sensitive. -

Build a lightweight business case that your sales team can repeat

Translate the earlier campus scenarios into your own numbers. Show the sales team how a single campus can equal low to mid seven figure material revenue. Connect that to the effort and calendar time to produce three to six EPDs. The goal is alignment. People sell with confidence when they can see the upside and the plan is simple to follow. -

Choose an LCA and EPD partner for speed and completeness

Manufacturers win when data collection is handled by a partner that can pull accurate utility, material and waste data from across plants with minimal disruption, manage the back and forth with the program operator, and publish on a predictable schedule. Look for a team that manages the messy data wrangling and relieves R&D and product management time. Ask about publishing pathways in both North America and Europe so you can match operator to market. You should not have to re-enter data three times to receive three declarations.

A quick refresher on EPDs, in plain English

Think of an EPD as a nutrition label for a product’s embodied impacts. It is built from a life cycle assessment based on a Product Category Rule that acts like the rulebook so everyone plays the same game. The result is a standardized, third party verified declaration that lets project teams model and compare products in design tools and in procurement. For data centers, that means your ESD topcoat or urethane cement mortar shows up in the embodied carbon model with your actual data, not a generic average.

Pulling the threads together

Hyperscale AI campuses now run to billions of dollars and millions of square feet, with U.S. spending near the 40 billion dollar annualized mark in mid 2025 and EMEA pipelines up by more than forty percent on the year (Reuters, 2025, Cushman & Wakefield, 2025). Resinous flooring does not cover every surface, yet it owns the critical zones, from static control in data halls to chemical resistance in battery rooms to fast cure in corridors. The iMasons letter put a date stamp on the expectation that suppliers will bring product specific, verified EPDs to the table so design teams can model credibly at the product level (iMasons Climate Accord, 2024).

The revenue at stake for resinous flooring is real, often low to mid seven figures per large campus, and the payback on a focused EPD push is measured in multiples, not percentages. Map your portfolio to the three data center buckets, pick flagships, close EPD gaps, and make your data visible where mission critical teams search. The window is open now, and specs are being written on a calendar, not a wish list.

Frequently Asked Questions

How large is the current hyperscale data center buildout in the United States and Europe?

U.S. data center construction spending reached about $40B annualized in mid‑2025, driven by AI demand (Reuters, 2025). In EMEA, there was about 10.3 GW operational, 2.6 GW under construction and 11.5 GW in planning, a 43% pipeline increase year over year (Cushman & Wakefield, 2025).

Where do resinous floors typically appear in data centers?

Three buckets recur. ESD epoxy or urethane in server halls and control rooms. Heavy‑duty, chemical‑resistant epoxy or urethane cement in battery, UPS and generator areas. Low‑VOC, fast‑curing epoxy, PU and polyaspartic in corridors, white space and support zones.

Why are hyperscalers asking for EPDs from suppliers now?

Embodied carbon in materials like steel and concrete can represent about 70% of a data center’s building‑phase footprint (UBS and Datum, 2024). The iMasons Climate Accord’s July 2024 open letter asked suppliers to provide product‑specific, third‑party EPDs to support Scope 3 accounting and comparable modeling (iMasons Climate Accord, 2024).

What is the payback on producing EPDs for resin floors?

One large campus can drive low to mid seven‑figure material revenue. If a single EPD helps win one such project, the payback can be 60–200x versus the EPD effort, and the declaration typically supports bids for several years.

Do I need an EPD for every SKU?

No. Start with 1–3 flagship systems in each of the three data center buckets. Consider family‑level EPDs where allowed by the applicable PCR to cover similar formulations efficiently.