What an EPD Tool Really Needs to Do

Searching for an EPD tool can feel like shopping for a “do everything” gadget. Some are calculators, some are publishing portals, and some are just glorified spreadsheets. Here is how to separate the helpful from the hype, and choose a setup that gets your product specified faster with less thrash.

First, what people mean by “EPD tool”

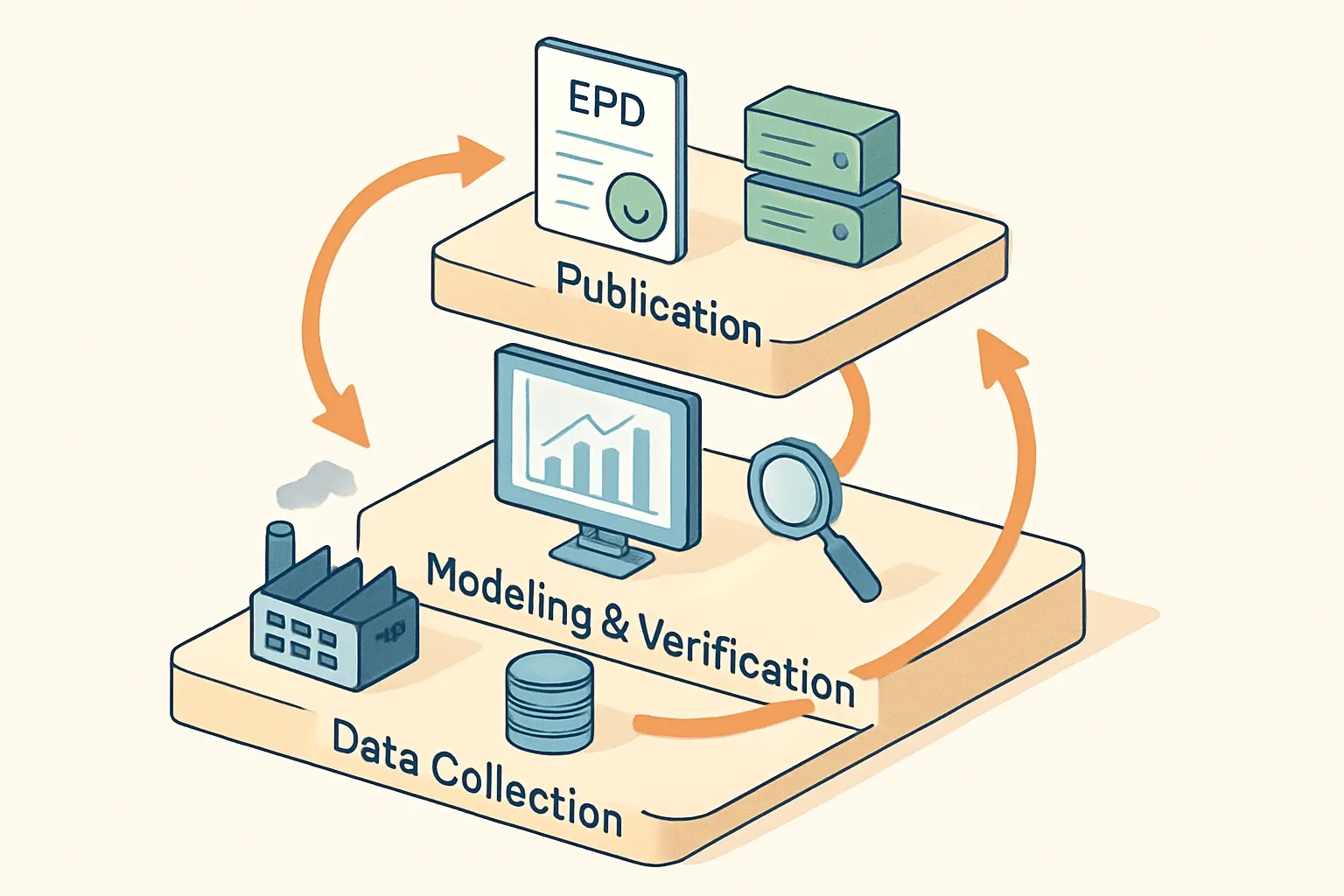

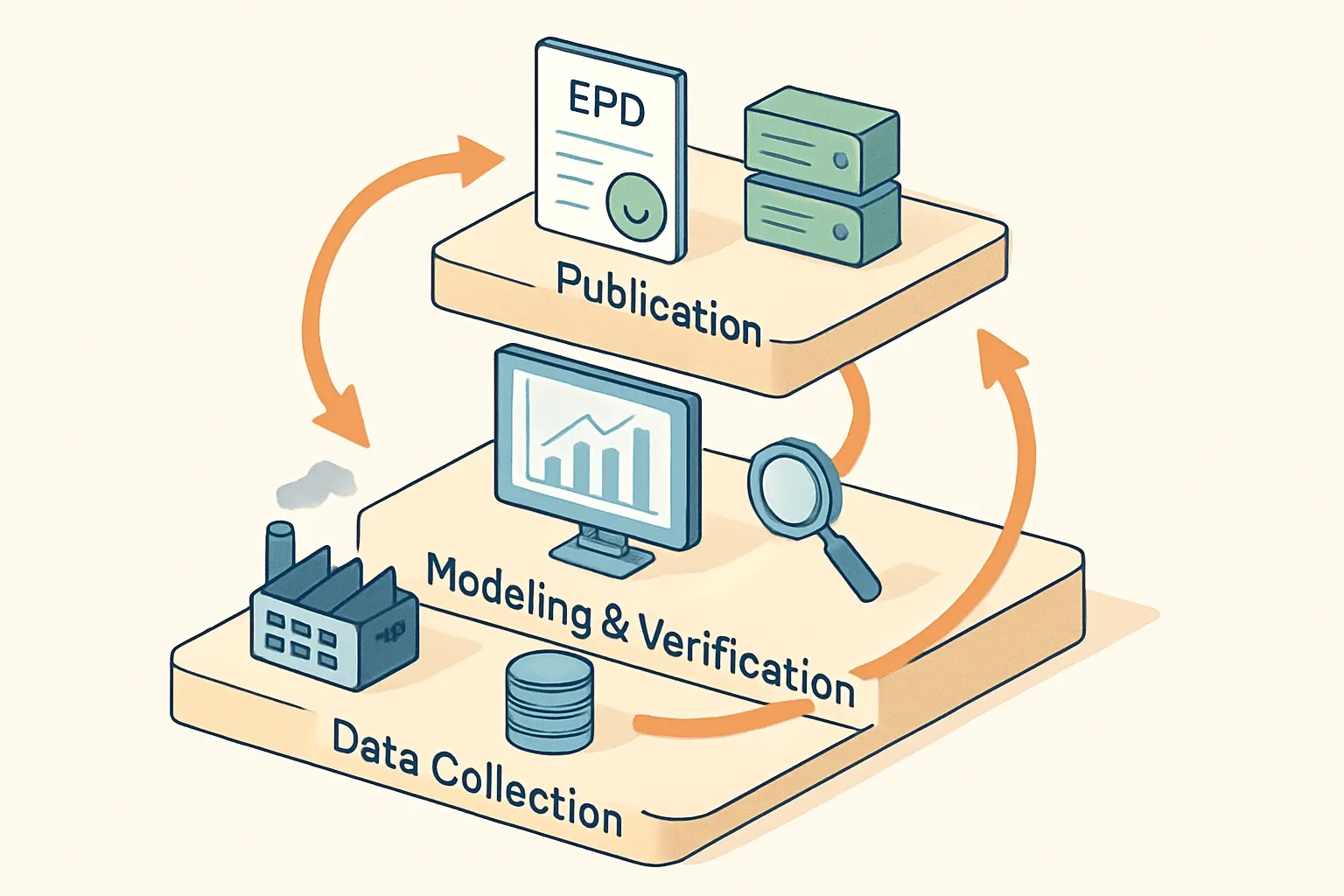

An EPD tool can be a modeling engine that runs a life cycle assessment, a workflow app that collects plant data and tracks verification, a portal that publishes the declaration with a program operator, or a library where specifiers find it. Think Swiss Army knife versus single screwdriver. You probably need a small stack, not one monolith.

The baseline a real tool must cover

To produce a publishable declaration, your stack must support the right PCR, a defensible LCA model, third‑party verification, and publication with a recognized program operator. EPDs typically carry a five year validity, and must be updated if an indicator worsens beyond set thresholds during that period (EPD International FAQ, 2025). If a PCR expires mid‑cycle, the EPD does not vanish, it stays valid until its own end date under the rules used at verification (EPD International GPI, 2025).

The landscape in plain English

Here is how the ecosystem maps when people say “epd software” or “epd calculator”.

- Authoring and modeling tools, where LCAs are built and checked against PCR rules.

- Program operator platforms, where EPDs are verified and published, such as Smart EPD in the US and IBU in Europe.

- Data hubs, where markets pull information. INIES for France and ÖKOBAUDAT for Germany are the big ones used in code compliance modeling.

- Spec and bid workflows that reference those hubs. LEED v5 workstreams continue to reward product transparency, so your data’s findability still matters.

INIES publicly shows scale, listing 5,432 verified FDES and 1,789 PEP on December 9, 2025, representing 315,484 commercial references, which tells you how buyers actually search and model today (INIES, 2025).

Ready to launch your EPD with confidence?

Follow us on LinkedIn for practical insights that help you get your products specified faster.

Compliance drivers you cannot ignore

State and agency rules keep EPDs commercially relevant even as some federal incentives shifted in 2025. California’s Department of General Services sets maximum Global Warming Potential limits for Buy Clean materials, effective January 1, 2025, for example 1,010 kg CO2e per metric ton for hot‑rolled structural steel sections (DGS BCCA, 2025). Caltrans requires EPD submittals for hot mix asphalt and concrete on projects with bid openings starting February 1, 2025, with a $6,000 withhold per missing EPD if not submitted within 30 days (Caltrans EPD, 2025). DGS also reviews GWP limits every three years beginning in 2025, and only allows downward adjustments (Caltrans BCCA FAQ, 2025).

Where software ends and white‑glove work begins

Most schedule risk hides in data collection across plants, suppliers, and ERP islands. The fastest teams assign a single orchestrator who requests utility bills, waste logs, QC data, transport legs, and monthly volumes, then validates them before modeling. We see that when the heavy lifting shifts off line staff, the calendar shrinks from months to weeks. It is not magic, it is ruthless coordination.

Features that actually speed you up

Look for practical capabilities, not buzzwords.

- Plant‑level templates that mirror how operations already record energy, water, waste, and yield losses.

- Multi‑plant modeling with clear rules for averages versus facility‑specific declarations.

- Built‑in checks aligned to EN 15804+A2 and the chosen PCR, including the 10 percent change trigger noted by several program operators during validity windows (EPD International FAQ, 2025).

- Evidence vaults and audit trails verifiers can review without email archaeology.

- Smooth handoff into a program operator portal, and export formats accepted by hubs like INIES or national libraries.

Publishing choices, explained without spin

Program operators are the gatekeepers who verify and host the final PDF and, increasingly, digital EPDs. In the US, Smart EPD has leaned into digital publication. In Europe, IBU is widely used for EN 15804. Pick based on where your products sell, the PCRs they support, their verifier network, and the downstream databases your customers rely on.

Data hubs are not optional anymore

If your declaration does not land in the right library, it might as well be invisible. INIES is essential for France’s RE2020 workflows, and it shows the current live counts openly (INIES, 2025). Germany’s ÖKOBAUDAT is free to use, curated by the federal government, and intended for building LCAs, with quality gates that filter what enters the database (BBSR ÖKOBAUDAT Data Users, 2025). Uploads and mapping can feel anything but straighforward, so plan for it early.

ROI, without rose‑colored glasses

Reliable averages for EPD project costs are hard to pin down since scope and data maturity vary. What we can say with confidence is that many public owners now treat EPDs as pass or fail submittals for key materials, and some attach real financial consequences to missing paperwork, like Caltrans’ $6,000 withhold per missing EPD in 2025 (Caltrans EPD, 2025). One mid‑sized project win often covers the full effort when a product shifts from generic data penalties to a product‑specific, verified EPD.

A practical way to pick your stack

Start with your market. If California or France are in scope, design for BCCA and INIES from day one. Decide on a program operator based on PCR fit and verifier access. Choose an EPD tool that solves data wrangling first, supports clean verification, and exports to the libraries your customers actually open. Then lock a reference year, pick the products that drive revenue, and move. The rest is just orchestration.

Frequently Asked Questions

How long is an EPD valid and when must it be updated within that period?

Most programs set five years as the validity period, with updates required if a reported indicator worsens beyond thresholds during that window (EPD International FAQ, 2025).

Do EPD requirements still matter after U.S. federal policy changes in 2025?

Yes. State and agency rules continue to require EPDs. California’s DGS maintains GWP limits for Buy Clean materials and Caltrans enforces EPD submittals with financial penalties in 2025 (DGS BCCA, 2025, Caltrans EPD, 2025).

Which databases matter for getting found by specifiers?

INIES in France and ÖKOBAUDAT in Germany are widely used in compliance modeling. INIES listed 5,432 FDES and 1,789 PEP on December 9, 2025, signaling market pull (INIES, 2025; BBSR ÖKOBAUDAT Data Users, 2025).

Will an EPD become invalid if its PCR expires before the EPD end date?

No. The EPD retains the validity it had at verification and is judged against the rules used then, until its own end date (EPD International GPI, 2025).