What New Hampshire H.B.306 Means for Manufacturers

New Hampshire’s H.B.306 never made it off the House table this February, but it spotlights a question bigger than one statehouse vote: if carbon gets a price tag, will your product data be ready for the checkout line?

Carbon pricing keeps creeping closer

Regional initiatives like RGGI already add about $14 per metric ton to New England electricity emissions (RGGI, 2024). Federal proposals keep surfacing in Congress. Even though New Hampshire lawmakers shelved H.B.306 in a voice vote on February 6, 2025 (Citizens Count, 2025), the debate is no longer whether carbon pricing matters but when and how it hits supply chains.

What H.B.306 actually said

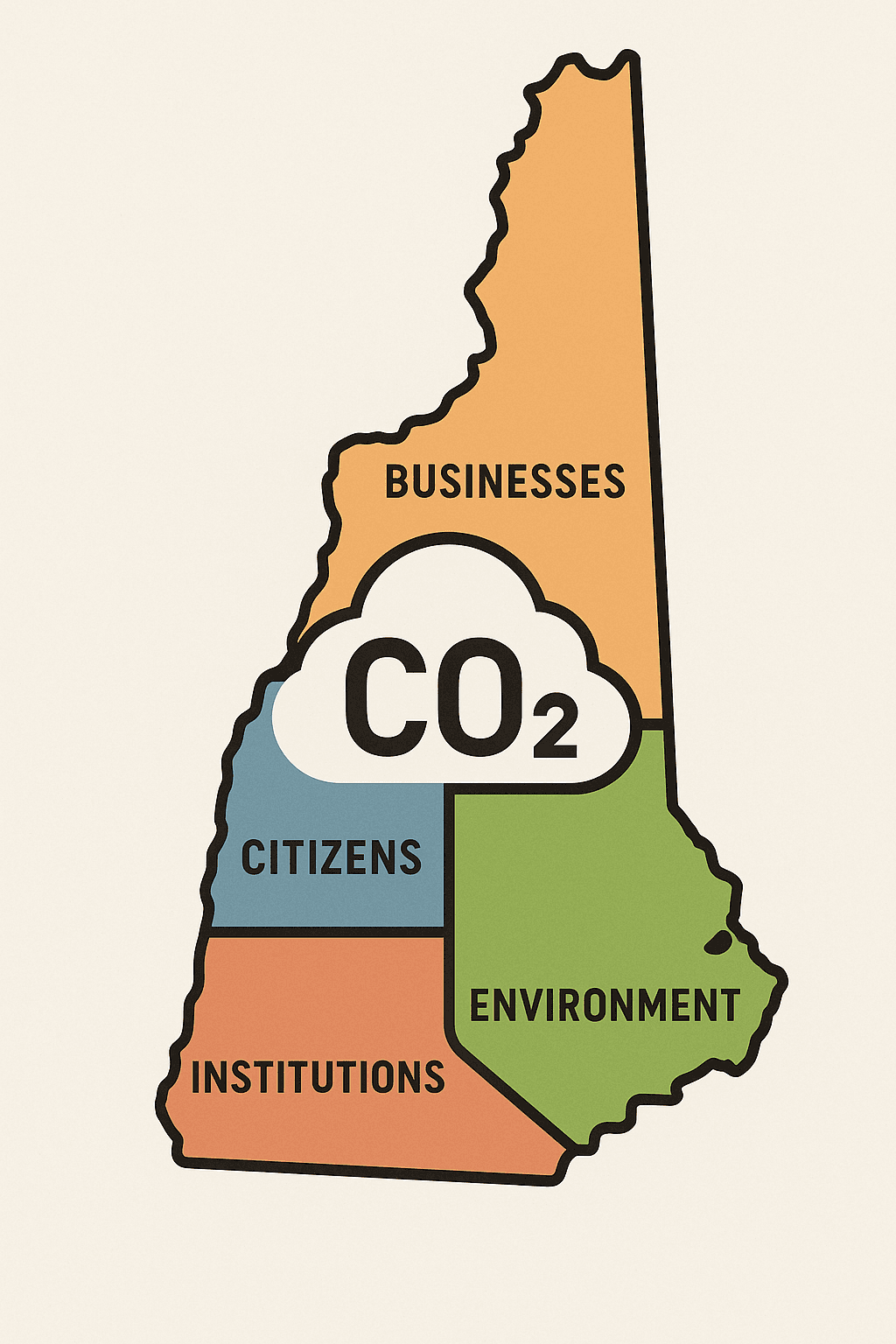

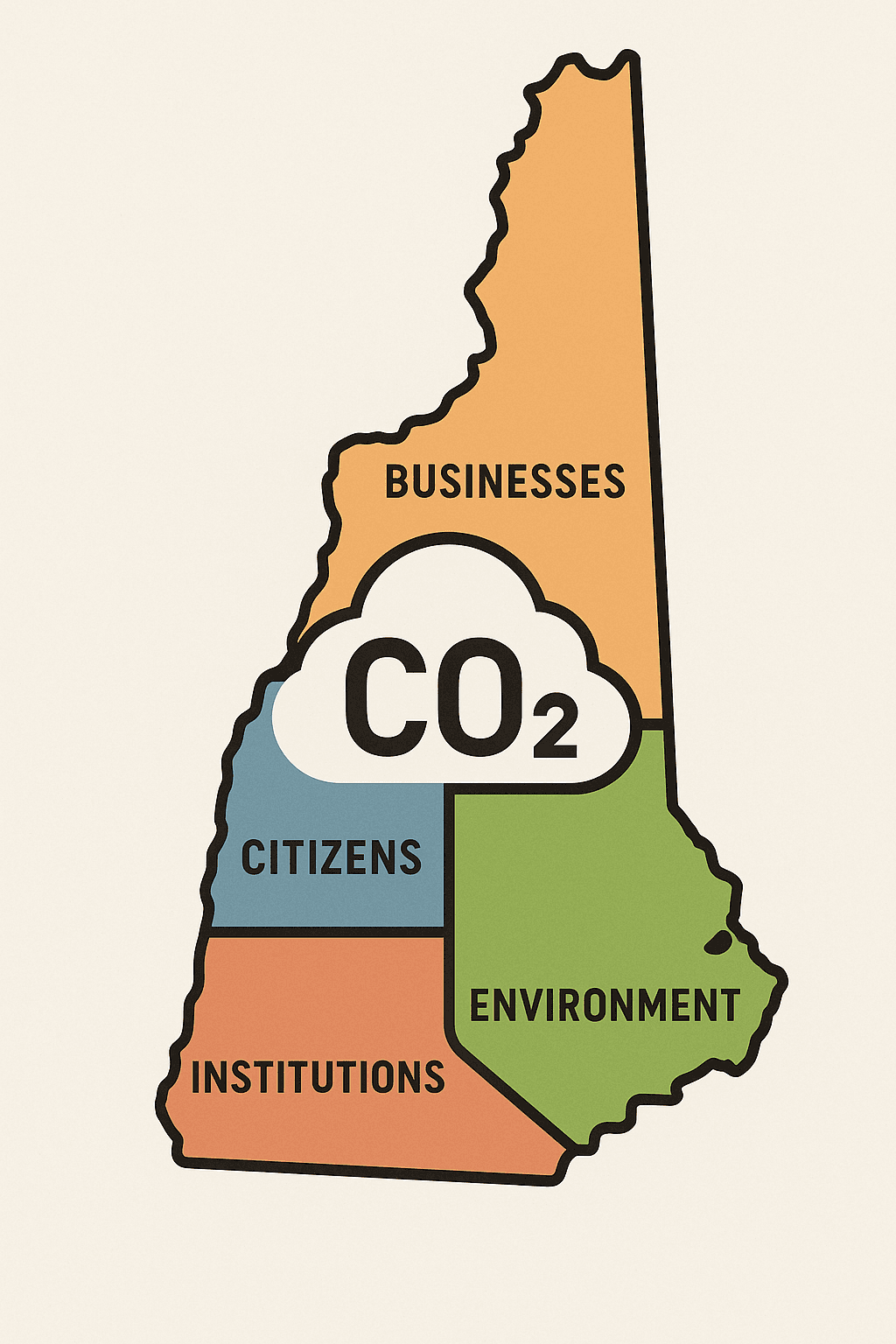

The two-page bill would have formed a 15-member commission to “study short and long-term impacts” of pending national and regional mechanisms on citizens, business, and the enviroment (FastDemocracy, 2025). That sounds soft, yet study commissions often write the first draft of future mandates. Think of them as the pilot episode before a full series order.

Why a tabled bill still matters to construction brands

Lawmakers pressed pause, not delete. Carbon accounting will resurface because New Hampshire exports building materials into Massachusetts and New York projects already scoring bids with embodied-carbon numbers. A state-level commission could speed-date those metrics into procurement rules almost overnight once refiled in 2026.

Want the latest EPD news?

Follow us on LinkedIn to get relevant updates for your industry.

Your data gap becomes a price gap

Carbon fees flow through invoices the same way freight surcharges do. If your hot-rolled steel joist carries an upfront Global Warming Potential of 1.8 kg CO₂e per kg while a rival discloses 1.4, that 0.4 delta could cost you an extra six dollars per ton at a $15 price. No EPD, no verified number, higher default factor.

EPDs as carbon currency

An ISO 14025-compliant EPD stamps third-party credibility on your CO₂ math. Agencies writing proxy prices lean on those declarations because they slot neatly into life-cycle databases and procurement scorecards (EPA, 2024). The sooner your declaration lands in EC3 or similar tools, the sooner you dodge penalty multipliers.

Quick-start checklist before the next hearing

- Pull 2024 utility and production data now while meters and minds are fresh.

- Confirm which PCR your closest competitor used; matching avoids apples-to-oranges comparisons.

- Map facility energy hotspots against RGGI allowance forecasts.

- Line up an LCA partner that can handle plant-level audits without hijacking your process engineers’ calendars.

- Budget for annual updates so your declared numbers fall year over year, not just first-year bragging rights.

Reading the room beats reading the bill text alone

H.B.306 may sleep for a session, yet market pressure is wide awake. Treat this lull like a pit stop: refuel your data, tighten documentation, and you will sprint past competitors still arguing about whether the race is real.

Frequently Asked Questions

Does a tabled bill like H.B.306 affect compliance deadlines right now?

Not yet. Because the bill did not pass, no new reporting dates apply today. The value lies in its signal that carbon pricing studies are moving up legislative agendas, so prepare before deadlines appear.

Will an EPD automatically shield me from any future carbon fee in New Hampshire?

No single document offers immunity. An EPD supplies verified emissions data that regulators typically accept in place of conservative default factors. That swaps uncertainty for numbers you can manage.

My products ship mainly to other New England states—should I still care?

Yes. Neighboring jurisdictions like Massachusetts already reward low-carbon materials in public projects. A New Hampshire carbon study could harmonize with those rules, making EPDs table-stakes region-wide.

How long does it take to gather the plant data needed for an EPD?

If your utility and purchasing records are organized, experienced teams can collect and verify one year of data in a few weeks, far quicker than the six-month industry rumor mill suggests.