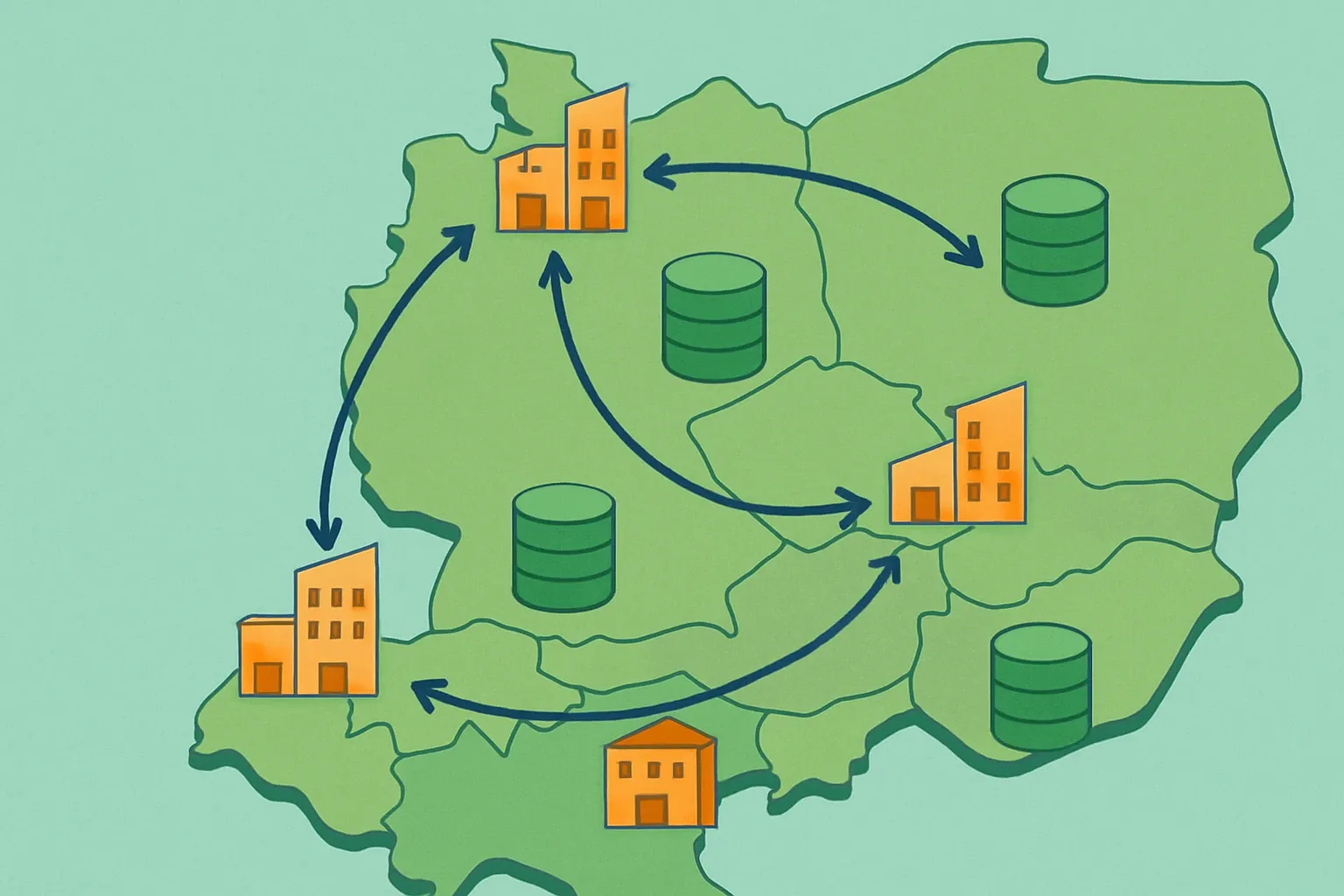

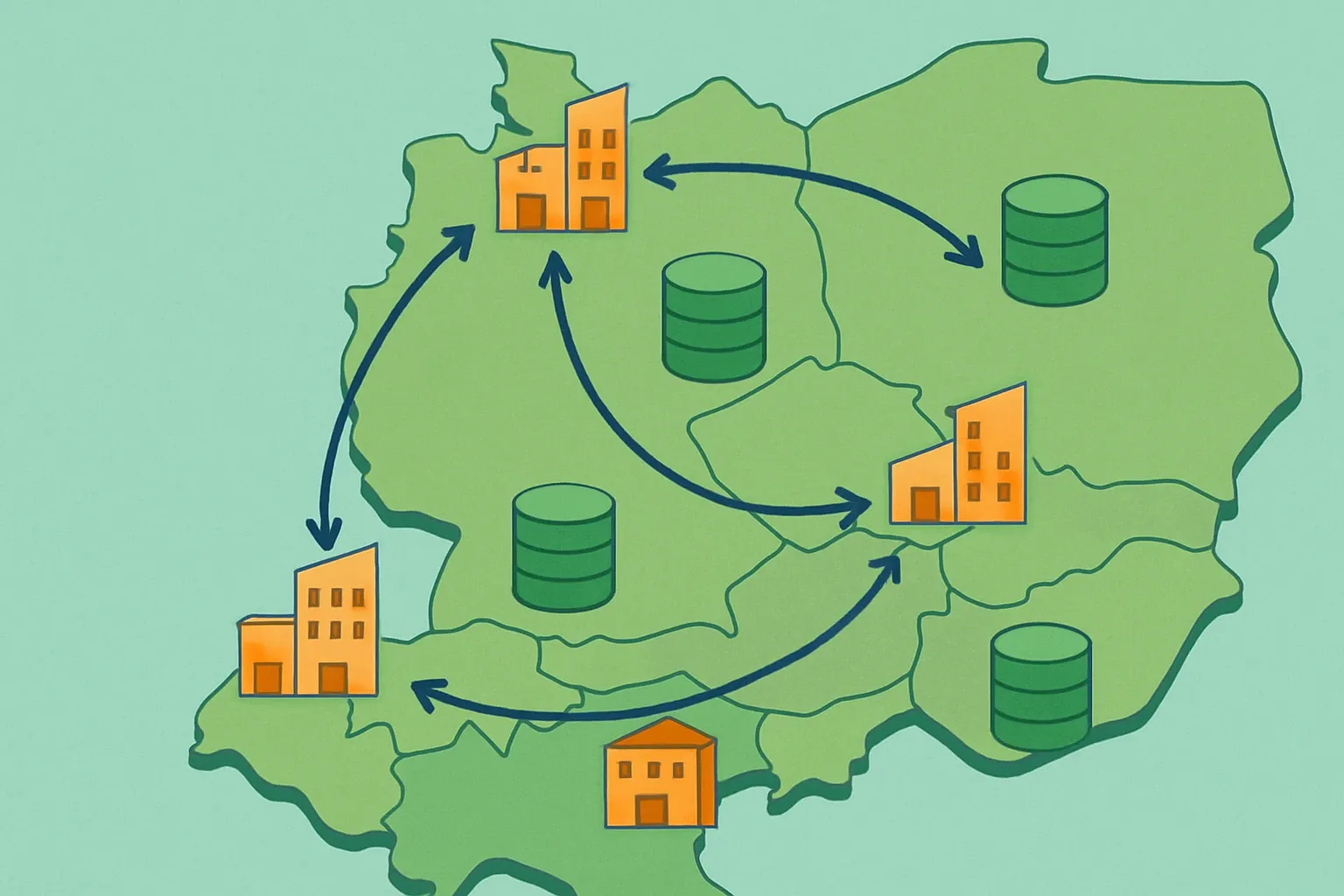

EPDs in Central Europe, mapped for 2025

Trying to win specs across Germany, Austria, Switzerland, Poland, and neighbors can feel like five chess games at once. The rules look similar, yet each board has its own quirks. Here is the fast, practical map for the EPD Central Europe landscape so product, sustainability, and sales teams can move in sync and stop losing time to paperwork fog.

The standards that set the ground rules

EN 15804+A2 is the rulebook. The A2 update effectively replaced A1 across European program operators by late 2022, with national withdrawals of older versions scheduled no later than October 2022 (nbau, 2022). IBU updated its PCR Part A in April 2024 to align with ECO Platform calculation rules, a helpful signal that A2 is now routine practice for verifiers and program operators (IBU, 2024).

Where your EPD needs to live

Central Europe runs on a mix of operator registries and national data hubs. Germany’s building LCA workflows reference the federal ÖKOBAUDAT database and sit under the BMWSB and BBSR umbrella, including use within QNG and BNB systems (BMWSB, 2025). France is not “Central” but often part of cross‑border sales. Its INIES base is the largest public hub in Europe with 6,324 total datasets, including 4,560 FDES and 1,342 PEP as of 31 December 2024, driven by RE2020 adoption (INIES, 2025). If teams plan to sell into France, budget for conversion to the national complement.

Germany snapshot

Most construction EPDs publish with IBU. Mutual recognitions exist with operators like Smart EPD, UL, BRE, and others, though some markets add national rules that require extra steps, particularly France and the United States (IBU, 2025). IBU confirms published EPDs are valid for five years, which is the timeline most buyers quietly assume for currency (IBU, 2025). For building LCA, expect pulls from ÖKOBAUDAT and digital use via IBU.data, so keep machine‑readable files tidy.

Austria snapshot

Bau EPD GmbH runs a national program whose EPDs flow into the baubook database. Inclusion supports Austrian building certificates and housing subsidies in six federal states, with recognition pathways for ECO Platform EPDs finalized by a short verification at Bau EPD GmbH when needed (Bau EPD, 2025). The punchline is simple. If your EPD is already ECO Platform aligned, plan a lighter Austrian step rather than a redo.

Switzerland snapshot

Project teams often use KBOB eco‑balance datasets for building LCAs. Newer KBOB versions were posted in 2024 and 2025, so check version alignment when you hand off data to modelers (ecobau, 2025). A parliamentary brief flagged the need to harmonize with EN 15804+A2 and the revised EU rules to avoid trade frictions and double declarations for manufacturers selling into the EU, which many Swiss vendors do (Swiss Parliament, 2025). Translation. Keep your EPDs fully A2‑compliant and ready for digital exchange, even when a project uses KBOB in the building model.

Navigating EPD regulations in Central Europe?

Follow us on LinkedIn for insights that help you win specs and streamline compliance.

Poland and neighbors

Poland’s ITB operates a national program and publishes EPDs used by local designers and by EU buyers that accept EN 15804+A2 outputs (ITB, 2025). Czechia, Slovakia, and Hungary sell widely into Germany and Austria, so publishing with a program recognized by ECO Platform is the shortest path to cross‑border acceptance. When bids mention BNB, QNG, or baubook, map your EPD and its XML to those ecosystems up front.

The new regulatory backdrop manufacturers must watch

Two EU policy tracks reshape how environmental data moves.

- Construction Products Regulation 2024/3110. The law entered into force on 7 January 2025, with most provisions applying from 8 January 2026. Penalty provisions for environmental performance declarations start 8 January 2027. Digital Product Passports will phase in under delegated acts, giving your product a machine‑readable identity across the EU market (FPS Economy Belgium, 2025). These dates mirror Council communications in late 2024 confirming adoption (Consilium, 2024).

- CSRD scope shift. A provisional EU deal in December 2025 raised thresholds so that CSRD would cover companies with more than 1,000 employees and over €450 million turnover, with transition relief for the earliest wave. Supplier data requests will still cascade into the value chain, but many mid‑sized manufacturers will fall out of direct scope for now (Consilium, 2025).

Practical operator choices for cross‑border sales

If your team typed “epd central europe” this week, you likely need one EPD that travels. Use this short test to pick a home.

- Publication gravity. IBU has the deepest pull in Germany and broad ECO Platform ties. Austria’s Bau EPD shortens recognition into baubook. INIES dominates France by statute, so budget a conversion when targeting RE2020 tenders. Numbers back the traffic claim for INIES in 2024, which matters for sales modeling (INIES, 2025).

- Data plumbing. Confirm your operator outputs valid XML and ECO Platform artifacts. Ask how quickly mutual recognition listings post per market. Hours saved here count more than a small fee difference.

- PCR fit. Align to what competitors used and check the PCR sunset window. IBU’s 2024 PCR Part A update incorporated ECO Platform rules, which reduces surprises at verification handoff (IBU, 2024).

ROI reality in Central Europe

Public projects that require building LCAs penalize generic data. A product‑specific, third‑party‑verified EPD keeps you in the model and prevents pessimistic defaults from quietly pricing you out. Teams that delay often discover that spec momentum moved weeks earlier when the LCA modelers populated their bill of materials. Hard numbers vary by product and country, and officials have not published harmonized penalty rates that apply across Central Europe in 2025, so do not rely on a single figure.

Timelines and housekeeping

Plan one reference year of production data, collect utilities and waste by site, and keep a clear audit trail. Verifiers expect A2 indicators, end‑of‑life modules, and Module D results in line with the standard. EPDs are typically valid for five years, so set a reminder at the 42‑month mark to refresh data and avoid an expiry dip in your pipeline (IBU, 2025). Prospective EPDs are possible for brand‑new lines, then reworked once a full year of production is available. That buys time when sales is pushing for a fast pre‑qualification.

A faster path, fewer handoffs

What wins in Central Europe is not a pretty PDF, it is a clean data machine. Choose an operator recognized by ECO Platform, publish in the formats your buyers actually use, and team up with a partner who handles data collection and project management so your R&D and plant leads stay on real work. Tidy inputs, crisp PCR choices, and early database mapping beat last‑minute heroics every single time. It is not glamorours, it is how specs are won.

Frequently Asked Questions

Is EN 15804+A2 fully mandatory in Central Europe or can we still publish A1 EPDs?

Program operators switched during 2022, with national withdrawals of A1 versions scheduled by October 2022, so A2 is the norm now for construction products (nbau, 2022). IBU’s 2024 PCR Part A aligned with ECO Platform rules, reinforcing the shift (IBU, 2024).

Do we need to place our data in INIES for Central Europe projects?

Not for Germany, Austria, or Switzerland. INIES is essential for France and shows 6,324 total datasets at 31 December 2024, including 4,560 FDES and 1,342 PEP, used in RE2020 workflows (INIES, 2025).

How long is an EPD valid and when should we refresh?

Five years is typical under EN 15804 programs. Start your refresh at 42 months to avoid a gap in bids. IBU states published EPDs are valid for five years (IBU, 2025).

What changes with the new EU Construction Products Regulation for EPDs?

Most provisions apply from 8 January 2026, penalties for environmental performance declarations from 8 January 2027, and Digital Product Passports will phase in via delegated acts (FPS Economy Belgium, 2025).

Does CSRD still apply to mid‑sized manufacturers in 2025?

A December 2025 provisional deal raised thresholds to over 1,000 employees and €450 million turnover, reducing direct scope. Large buyers will still cascade data requests down their supply chains (Consilium, 2025).